In recent years, widespread use of sophisticated mathematical, statistical and deterministic models has allowed financial institutions to make strategic decisions with a new level of knowledge. At the same time, these models have led them towards additional needs: quantifying, measuring and managing model risk. On top of that, regulators have put increasing pressure on financial institutions to make sure they adopt an enterprise framework for model governance. The additional requirements are because of the greater importance of model risk; financial institutions could make incorrect decisions or financial errors because they lack solid, well-designed process management.

This will not change model life cycle phases (development, validation, deployment and audit). What changes is the model governance.

Model governance as core business function

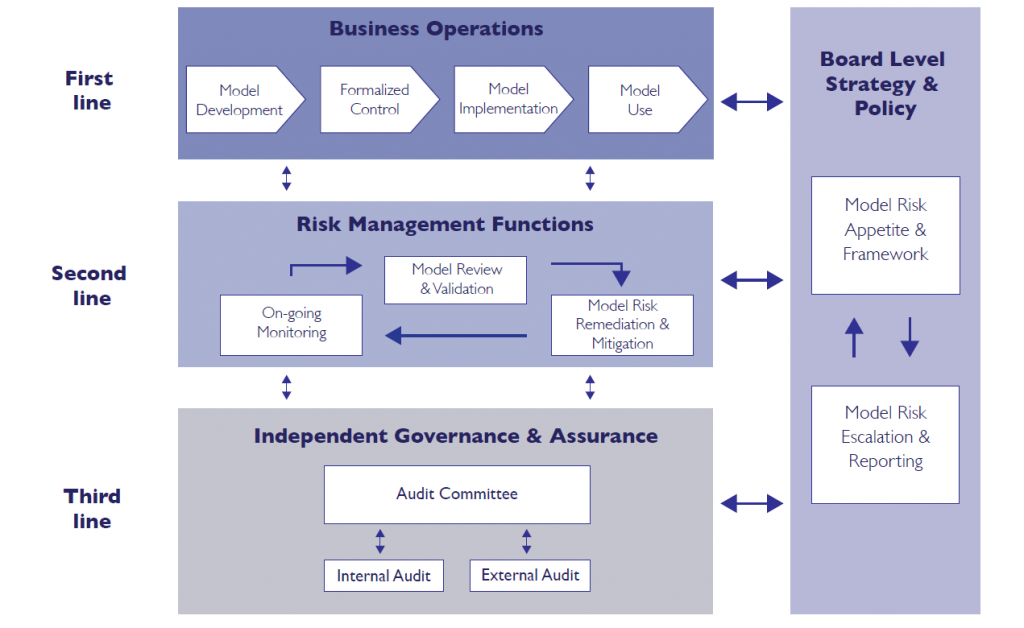

Model governance should ensure the alignment of the whole model life cycle, with three lines of defence: business operations, risk management function, and effectiveness and efficiency of model risk analysis. This is why it becomes one of the most critical factors.

The first line, represented by business operations, deals with model development, activity and availability. The second line, the risk management function, is in charge of model management and validation. Model performance monitoring is executed within the second line in order to verify consistency, validity and efficacy. The third line of defence, which completes the entire governance picture, deals with internal auditing. The contributions of internal audits include:

- The evaluation of activities for effective and efficient model risk analysis.

- The notification of deficiencies and process improvements.

These three lines of defence must be assigned to independent and separate departments in order to meet evolving regulations and to satisfy regulatory compliance.

Key elements of an efficiency model governance approach

We have identified eight key elements for efficient model governance based on experience working with customers and elements provided by regulatory guidelines. The key elements can be considered fundamental structure for a solid and valid framework of model governance.

1. Development

Management of model risk begins in development. The most important elements involved in the process (such as the developers who lend their experience to model definition) are at work here. The written documentation that describes every step of the process becomes essential for the quick and easy identification of the different correct phases.

2. Validation

This is considered the core phase to test models and classify their solidity. Validation refers to the statistical methodologies used, the input/output information and the performance. From the governance perspective, important elements to be considered include where to find all the necessary information and when the validation material is incomplete.

3. Approval

Designing, building and distributing reports are critical for a complete view of model governance. Approval is an essential element for financial institutions to send reports to regulators.

4. Modification

With model customisation, incomplete or partially complete documentation is a common scenario (most of the time, it is identified with an unofficial document). That practice is currently under regulator care, which requires that all the elements related to the model are quick and easy to find.

5. Implementation

In the stage of implementation, the model is taken over and managed by several departments. The risk here is that some basic components – such as references to origin sources, model execution codes or technical documents – can be lost. A framework that governs the overall process becomes central so those involved can perform their activities without a well-identified and configured design.

6. Retirement

Usually model retirement is undervalued or underestimated compared to the other phases. However, it is crucial for model performance that the best decision is made and to change the model when it is not efficient enough.

7. Model inventory

Model inventory is essential to obtain the big picture about what models are currently in place, which are unused, what will be used, etc. It is a synergistic view, looking at everything in relation to the models from a single point of view. It allows you to track every object linked to models (including documentation, codes and data) and identify every phase in the model life cycle (basically, all the elements that contribute to model risk evaluation).

8. Information sharing

In a complex process, communication becomes an essential factor for the actors involved, especially when there is a parent-child relationship of dependency in the phases. A governance framework allows better information sharing in terms of notification, messages, reports or documents to support and govern the entire process of model life cycle.

A sustainable framework

Financial institutions have to equip themselves with a sustainable, solid and valid model governance framework in order to manage risk models. Financial institutions can use the model governance framework to create a proper culture of model risk management. Today it is no longer an option – regulators request it. To learn more, watch the SAS Risk webinar series, where our experts will present best practices based on real cases and experiences on the SAS approach to regulatory compliance.