Note: Following is an eight-part serialization of selected content from Steve Morlidge's The Little (Illustrated) Book of Operational Forecasting.

Note: Following is an eight-part serialization of selected content from Steve Morlidge's The Little (Illustrated) Book of Operational Forecasting.

Forecasting is not compulsory

Operational forecasting is important but it is not mandatory.

operational forecasts are used to make sure that a business can respond effectively to customer demand for its products or services.

But, if you could respond instantly to customer demand then you wouldn’t need to forecast at all.

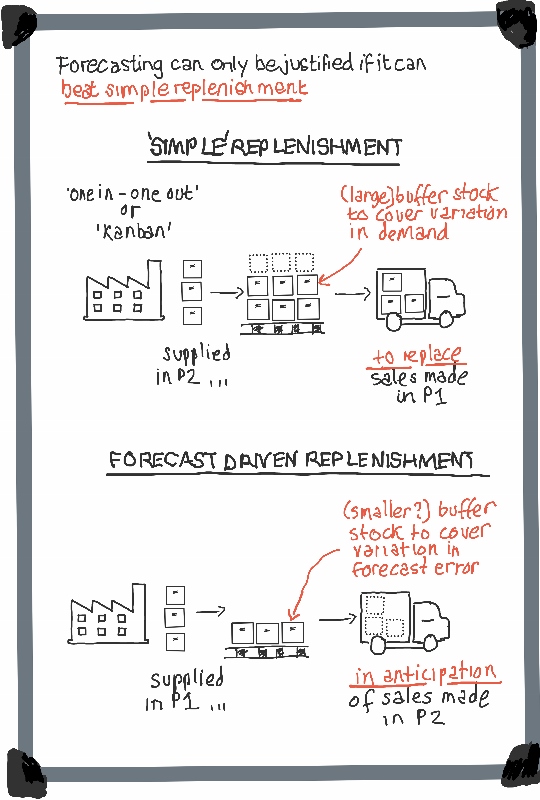

Since most businesses cannot respond quickly enough, they have to produce or buy products in advance of demand and hold reserves in the form of safety stock or spare resources to be sure of satisfying customer demand. The level of buffer needed is determined by how well you can anticipate demand – how good your forecast is.

The very simplest approach is to assume ‘no change’ – that you will sell the same tomorrow as you sold today. This is sometimes called ‘Kanban’ after the approach to replenishment used in ‘Lean’ manufacturing. Forecasters would call this the ‘naïve forecast’.

Professional forecasters might not regard this a ‘real’ forecast because it is very crude. But anything more sophisticated is only worthwhile if it is capable of outperforming this simple ‘one out, one in’ method of replenishment. If it can do a better job of anticipating demand, less stock will be required to provide a given level of customer service, which is the only reason why forecasts are needed.

TAKEOUT

Always remember: the goal of operational forecasting is not to produce accurate forecasts; it is to make better replenishment decisions than by not forecasting.

Coming Next: Data series are different - and it matters to forecasters

Like any craftsperson a good forecaster needs to choose the tools that is best suited to the job in hand. Good forecasting starts with an understanding of the pattern of demand, since this will determine what kind of forecasting methodology is likely to be most effective. This lesson identifies the key types of demand pattern that they are likely to encounter.