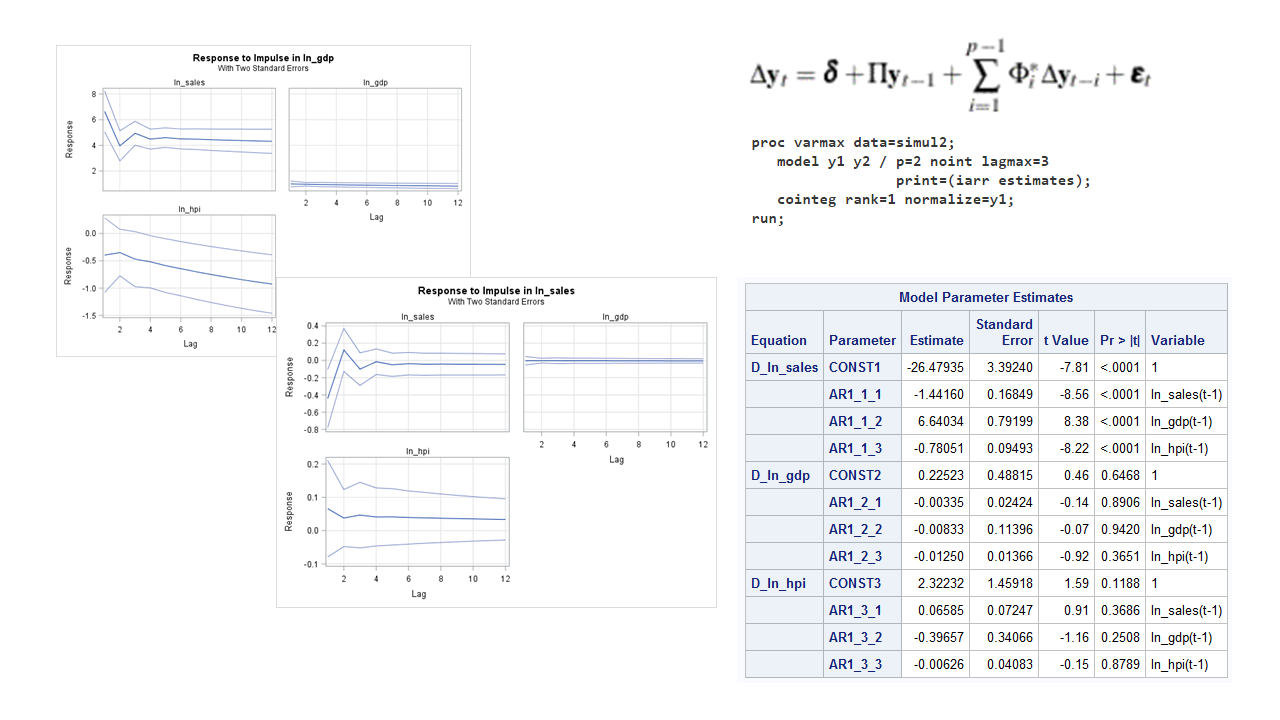

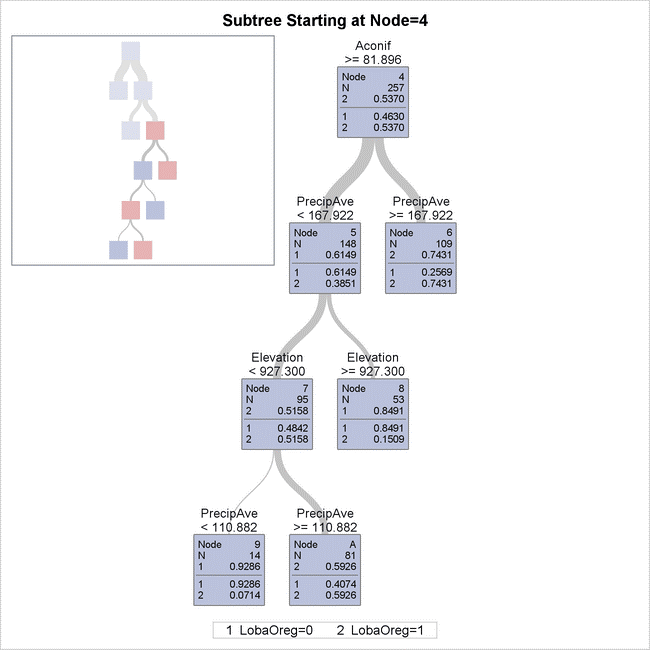

As an economist, I started at SAS with a disadvantage when it comes to predictive modeling. After all, like most economists, I was taught how to estimate marginal effects of various programs, or treatment effects, with non-experimental data. We use a variety of identification assumptions and quasi-experiments to make causal