A year ago, the compliance community was stressed by the enforcement of AMLD4 and its consequences for all financial institutions in Europe. At that time our experts were also summarising the analytics capabilities that need to be deployed for optimising existing AML solutions, improving the risk-based approach and the overall efficiency of the control framework.

With this new article, I aim to answer the following question: “What has eventually happened? And moreover, where are we today?”

It was inevitable that AMLD4 would be enforced, and all countries have adopted it step by step into their own legislation. From a state perspective, it was challenging for several reasons (e.g., risk-based approach at market level, ongoing monitoring of financial institutions, unharmonised predicate offences). But it seems that it’s an even greater challenge for concerned financial institutions, even though this fourth regulation isn’t considered to be revolutionary.

In 2017, surprisingly, many financial institutions were still busy implementing AMLD3, and therefore AMLD4 was increasing their concerns and stress. It would be complex summarising all experiences and concerns financial institutions were tackling, so let’s focus on three areas where we have seen the most traction from our customers towards comprehensive AML solutions and the use of analytics.

Identification of PEPs

First, the identification of domestic and international Politically Exposed Persons (PEP) is a major concern. The identification of foreign PEPs was already undertaken by financial institutions, but now financial institutions have to perform these tasks also for the domestic PEPs. Using legacy systems has, of course, the consequence of creating a huge number of false positives. By helping banks deploy advanced analytical algorithms for name matching, however, we can drastically decrease the false positive rate. These algorithms use not only transliteration capabilities (needed for international names), but also domestic language analysis. We also helped many FIs with the integration of new lists including all PEPs. But the most interesting part was that we started doing the same for new businesses, in that we received requests to help pension funds, life and nonlife insurance companies – and even online brokers.

How will the profession and its practices change in future; threats and opportunities for us who are dedicated to combat financial crimes? Join Christopher and others 25th April in Solna, Sweden, for a half-day seminar on Financial Crime Prevention.

UBOs - connecting the dots

The second topic area concerns the ultimate beneficial owners identification (UBO). This identification process is clearly along the same lines as the PEP, but gets more complex and requires even more focus due to the multiple consequences (sanction, reputation, risk assessment, etc.). UBO identification is, in theory, not complex. Every physical person who owns more than a certain percentage of a company (in general 25 percent, but can be 10 percent in some cases) is in theory a UBO and must be fully identified and enter the due diligence process. This raises some questions:

- What diligence should FIs deploy when a UBO is also a PEP?

- What must the FI do when the UBO is also a UBO of other organisations?

- What must it do when there is a circle of persons who are UBOs of UBOs of the same companies?

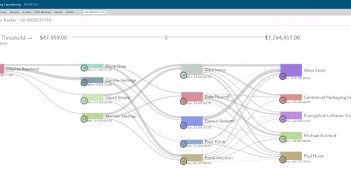

Some of the questions raised by our clients were related, for example, to existing companies acquired by other ones where newly identified UBOs were on PEP lists or blacklists. By integrating new lists in SAS® Anti-Money Laundering and deploying new capabilities to graphically display networks of UBOs, our customers improved investigation accuracy and efficiency. Visualising a company ecosystem and connecting the dots in terms of natural persons related to corporate entities helped a lot, and increased the speed of the investigation and comprehensive due diligence of the UBOs.

Tuning AML detection scenarios with model management

Last, but not least, is the concept of model risk management applied to AML. We have had clients tell us the regulator visited them and was challenging not the detection mechanism, but the thresholds and variable tuning. “Why do you use 8000€ for a threshold? Why not 7598€ or 7899€, etc.?” Our clients asked us to provide new models like the ones used in risk management, but adjusted to compliance. We developed new forensics and visualisations to identify statistically what the thresholds should be. In other words, we developed statistical methods for tuning AML detection scenarios, but at the level of the end user who is not a data scientist. Today our clients can demonstrate they are adjusting their rules daily based on this unique tuning methodology.

We developed statistical methods for tuning AML detection scenarios, but at the level of the end user who is not a data scientist.

These three examples are just a subset of what we have achieved. Just in Europe in 2017, on top of over 100 clients, we helped 20 new FIs and deployed various new models with all of them.

But what are the next steps? The EU is now working on the AMLD5. Our clients are experiencing the same stress as last year! The new directive will focus on monitoring more in-depth subjects, including:

- Crypto or virtual currencies

- Electronic wallets

- Prepaid cards

- Currency exchanges

- Enhanced customer due diligence

- Trust companies and other legal arrangements

- Redefinition of high-risk jurisdictions

- Correspondent banking

- More rules on PEPs

- Ownership of corporate entities

- Data protection

- Record retention, etc .

Another subject we constantly discuss at the moment are the capabilities of artificial intelligence and machine learning for enhancing AML detection. So far in Europe, most of the banks look at it, but no one we’ve met has made the decision yet to cross the line and use this technology. For sure by my next article, this will have changed.

More challenges are definitely ahead with AMLD5, and I hope that with my team we will be able to resolve those by using SAS technology and developing more new analytics.

More … very soon!