I have to confess: when it comes to Christmas, I'm a "real man". I do everything at the last minute, and certainly do not risk starting too soon…

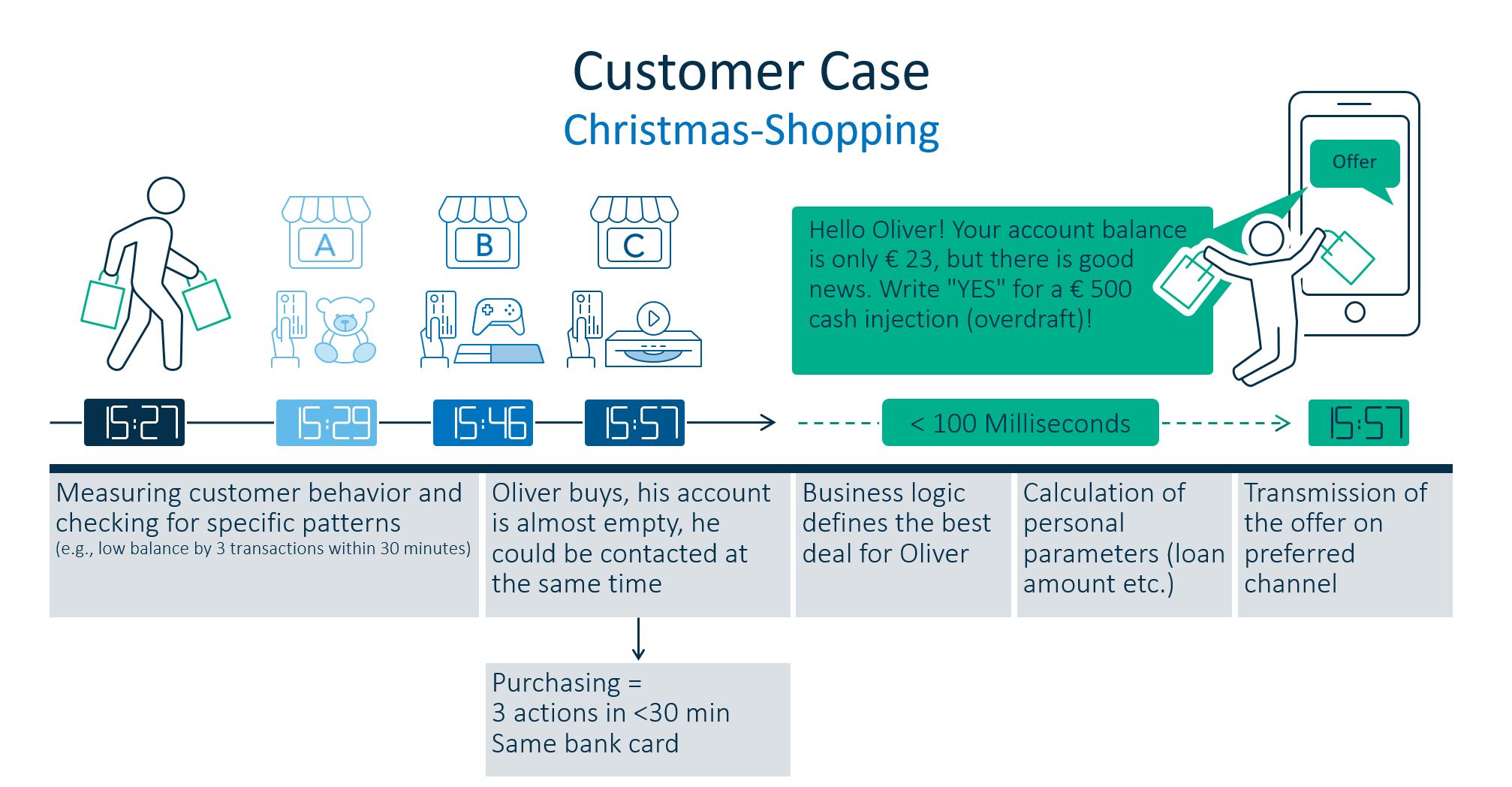

And that's exactly how it was last year, when I realized that it was Christmas Eve, and I still had no gifts for my wife and children. I am, however, a real man, so I did not panic, but simply took a deep breath and headed off to the big shopping centre in the next town. First the children: toy shop, electronics store. I was on a roll, and everything was done in less than half an hour.

After that, gifts for the best wife in the world. I was just considering buying a very nice piece of clothing, when my smartphone vibrated with a message:

"Hello Oliver, your current account balance is just 23.12 euros. But we have good news for you: confirm here in the mobile app and you will receive an extended overdraft limit of 500 euros including a payment break until January!"

What? My Christmas shopping had been successful, but clearly very expensive. Fortunately, my bank had responded immediately, saving me the embarrassing experience of having my credit card turned down at the till. What’s more, I could continue my shopping spree and buy something nice for my wife. What a positive customer experience!

What had happened?

My bank had processed all my transactions and evaluated them in real time. Based on my behaviour (visiting several shops in a short time), a central decision logic developed this ideal offer for me as the "Next Best Offer".

This took into account the overall context of the situation—not just the immediate events (my Christmas purchases), but all available information. This included my customer master data, account information, current account balance, and my complete history, together with analytical models of the risk that I posed.

Only by combining all this information could my bank put together a real and real-time 360-degree view of me as a customer, and create this opportunity to make the right offer immediately via my smartphone. Alternatively, depending on the customer segment or person involved, another channel such as Messenger or even the call centre could have been used.

This was a win–win situation: I had a positive customer experience as I was able to pay for my wife's Christmas present and, at the same time, my bank earned the overdraft fees. Everyone was happy, including my family, who all got their Christmas presents!

Sounds too good to be true?

No, absolutely not! This kind of scenario is already happening, with banks operating real-time customer engagement solutions from SAS. And this scenario could easily be extended to include fraud detection and prevention.

Suppose that my three purchases had not taken place in one shopping mall, but within just 30 minutes in a store in each of Hamburg, London and Beijing. The same central decision logic would evaluate all the information and decide that I could not possibly have made all those purchases myself within that period of time. It would therefore issue a very clear fraud warning. These are not, however, rigid (programmed) rules, but analytical machine-learning methods that adapt and consider the customer as a whole.

Let's expand the example again, this time to Internet purchases. Here, it is very possible to shop from a German, English and American online shop within a 30-minute period. If these are shops in which I have previously shopped or their products fit my previous behaviour, then the central logic system would decide that everything is “okay”. If there was any question, I would see as a warning of some sort during the payment process.

All this is already possible today, but only with a central real-time system that does not look at events and activities in isolation. Instead, it must always take the overall context into account.

Would you like more examples of using SAS solutions for real-time customer engagement? Take a look at the white paper 7 Best Practices for Delivering a Better Customer Experience