If you’ve been a regular reader of my musings over the years, or heard me bring these thoughts to life in-person at an event or during a webinar, you’ll know that I like to rely upon a few tried and tested phrases. One of my favourites is “’x’ [insert technology or strategy]is not all-new for ‘y’ [insert year]”, and is used when I want to illustrate that we’ve seen or heard something before.

When you’ve got a few thousand miles on the clock – having journeyed through the software vendor, industry analyst and end-user worlds over the last 22 years – it’s rare to find a topic or technology which hasn’t previously been examined at length. To be clear, I’m not complaining at a lack of ‘wow’ in my life. Rather, I’m grateful for the opportunity to revisit past subjects to see how they’ve evolved in response to changing operating conditions and/or technical advancements. Which brings me neatly to the focus for this blog, namely cost and profitability analysis [which is not all-new for 2017/2018!].

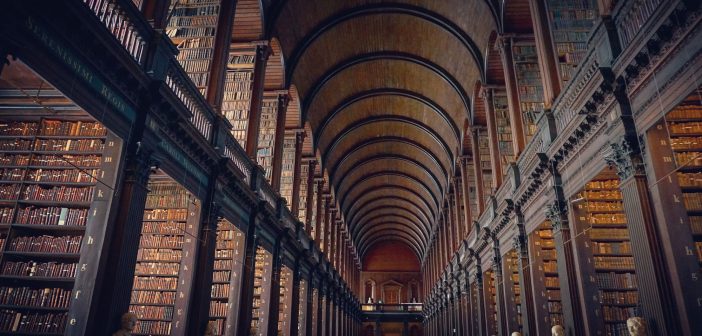

A voyage into the SAS library

Since joining SAS at the beginning of October 2017, I’ve been on a fascinating voyage of discovery into our capabilities and culture; our people and partners; our processes and protocols; and our product portfolio. I’ve had intro meetings by the dozen; taken numerous online training courses to test my understanding; browsed far-flung corners of the intranet to see what well-kept secrets are to be found in our capacious archives; and consumed content as quickly as possible (without the need for the digital equivalent of Gaviscon).

SAS’ repository is like a 21st century equivalent of the Library of Alexandria, and for someone like me – who’s blessed with a restless curiosity and a desire to continuously keep learning – it’s a fabulous environment to spend time within. And it was here that I unearthed this article from June 2010 written by my esteemed colleague Leo Sadovy, which takes a 101-style look at cost and profitability analysis.

The right underlaying data

Rather than regurgitating it in full here, you can read it at your leisure and I’ll just summarise the main argument instead. Achieving effective outcomes in a comprehensive cost and profitability analysis requires an organisation to perform three simple steps:

- Get good data

- Analyse the data

- Use the insight to make good decisions

Fast-forward a few years, and these fundamental points remain as relevant ‘now’ as they did ‘then’. It’s impossible to perform a veracious assessment of cost and profitability without having access to the right underlying data. This data comes from a variety of sources (step 1), is delivered into the analytical engine in high volume and at equally high velocity (step 1), and needs to be interrogated thoroughly and in a timely manner to extract maximum value (step 2). From there, it’s all about using new-found knowledge to make sensible fact-based decisions (step 3). It’s not rocket science (unless you’re working in the ballistics industry). Technological advancements in the period from 2010 have made these tasks easier, and, as the work being performed by SAS’ R&D department demonstrates in the search for new algorithmic capabilities, there’s always room for further progress.

The discovery

Reading Leo’s 101 from 2010 led me to discovering a more comprehensive assessment into what’s required to achieve mastery in cost and profitability analytics, which was performed by our friends at Accenture in 2014. I was struck by this paragraph, which I’ve quoted verbatim:

“Most companies today struggle with identifying which of their offerings and which of their customers are the most profitable. They can measure revenue but not the profit associated with the product or client group – which means they make decisions about what to sell, in which markets, to which customers, and at what price based on partial or inaccurate information. They operate without a single version of the truth. Methods used to allocate large buckets of costs such as sales, advertising and customer service can be arbitrary and potentially inaccurate.”

Future advantages to be gained

As 2017 comes to an end, my sense is that the situation described by Accenture still largely holds true. While some firms have undoubtedly made progress towards closing gaps in their understanding, others are lagging for a variety of operational and technological reasons. Amid the challenging macro-economic conditions of the late 2010s, and with competition for a share of customer wallet intensifying, there’s never been a more critically important time to improve cost and profitability analytics. I think there are huge commercial advantages remaining to be gained for companies across a broad swath of industries, and there’s simply no excuse to not a) know your customer, b) know your costs, and c) know what drives your profitability. If you want to be shown the money, then you’ve got to know where to look.

If you’d like to debate the merits, and current state, of cost and profitability analytics, then join members of SAS and Accenture for a lively Twitter debate on December 14th 2017 at 6pm CET / 5pm UK / 12pm Eastern / 9AM PT. Simply go to www.twitter.com or use the app on your smartphone or tablet, and search for #saschat and #profitability just ahead of the session starting.

Here are the questions for the #saschat:

Q1: Who are stakeholders for profitability analysis within an organisation?

Q2: How can better data be sourced on a continuous basis to improve profitability analysis?

Q3: As real-time customer experience becomes more pervasive, how will this impact profitability analysis?

Q4: How does reconciliation with the published P&L impact operational profitability analysis?

Q5: Who in the organization owns profitability analysis from a governance perspective?

2 Comments

I missed this event, could you send me information on cost and profitability.

Thanks for getting in touch Harshil. I'll get some additional information emailed to you. Are you seeking anything specific?