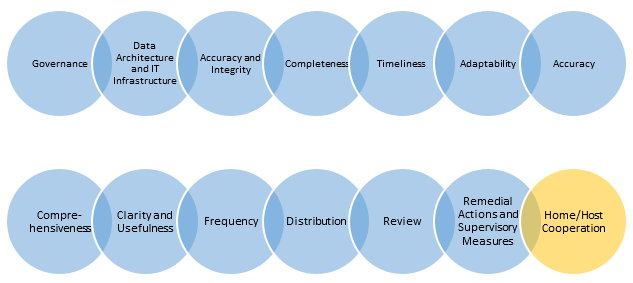

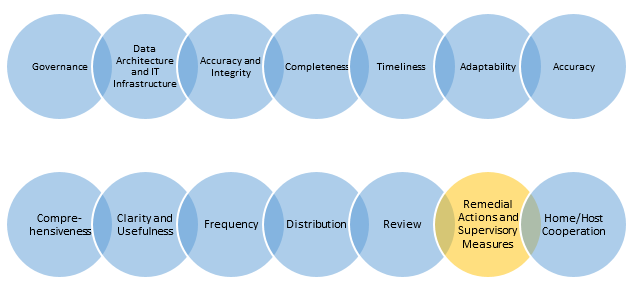

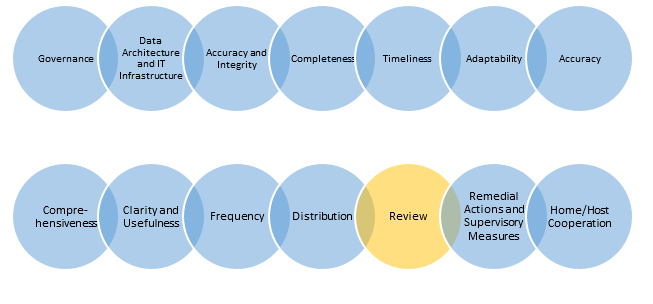

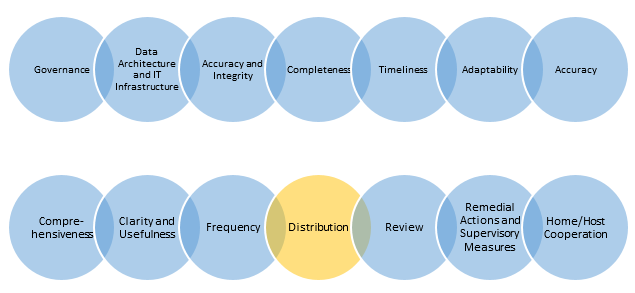

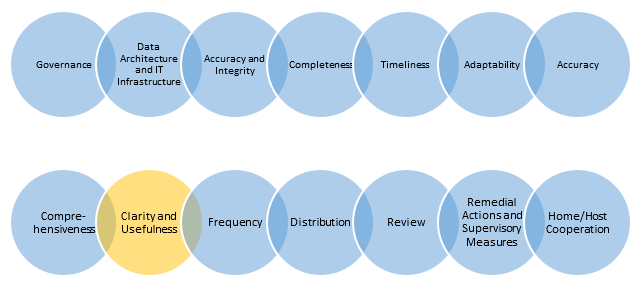

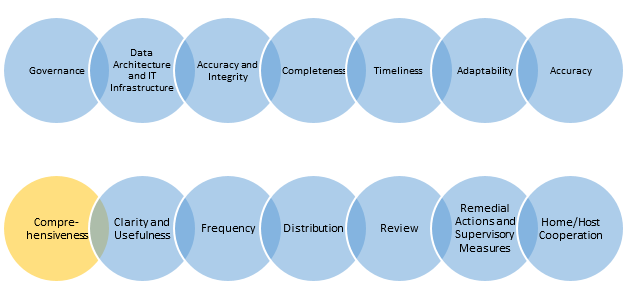

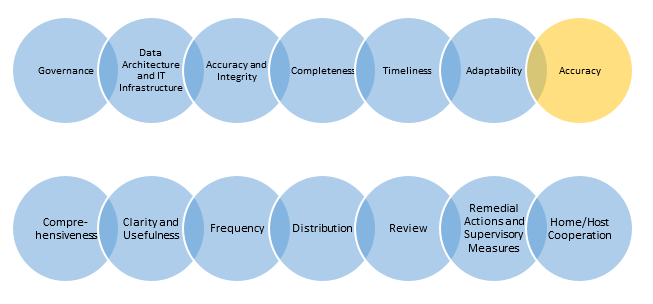

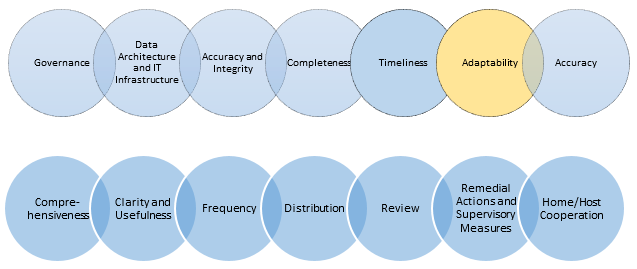

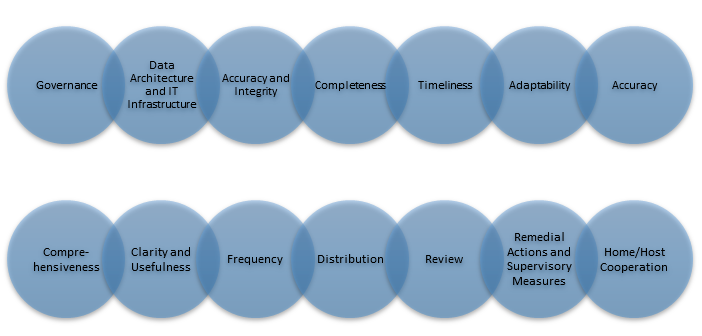

Three months ago, I introduced the SAS series on the Principles of BCBS 239 written by my colleagues. We wrote the series to help banks in their compliance with the Principles of BCBS 239. An integrative, consistent process reaching across all banking disciplines is now the desired goal of many