In an increasingly complicated operating environment, the global oil and gas industry struggles to optimize their asset portfolio. Producers combat severe challenges inherent to aging facilities in the context of pricing volatility. Change is the new constant, as the cyclical nature of the oil and gas industry means that producers struggle to move out of a debilitating trough to a manageable peak.

During the industry troughs when margins are squeezed, it is necessary for operators to focus on asset portfolio management. How do operators maintain asset integrity and deliver additional production in mature fields? The problem associated with production facilities can be diluted into a binary solution; either extend the lifecycle of or decommission an asset.

Due to commodity price concerns and OPEC discord in tandem with increases in U.S. production, it is imperative to maximize production in mature fields while reducing Opex. The best practices for asset portfolio optimization are also the drivers to achieve such goals.

The industry is striving for optimal asset management by calling upon digital innovations in the field of data science and advanced technologies matured in other verticals. Advanced analytics can improve the methodologies used by geoscientists to perform monitoring and surveillance of all activities across oil fields.

Producers need an analytic-infused asset performance management system as they evaluate the best options to addresses underperforming wells, reservoirs, and fields. As input variables change in a dynamic environment; an operator must leverage best practices to identify the impact of these changes proactively. Rapidly converting data to insight to action is the key to enhancing the portfolio. Coalescing all ideas and techniques to achieve the panacea that is asset portfolio optimization is a sustainable and scalable goal.

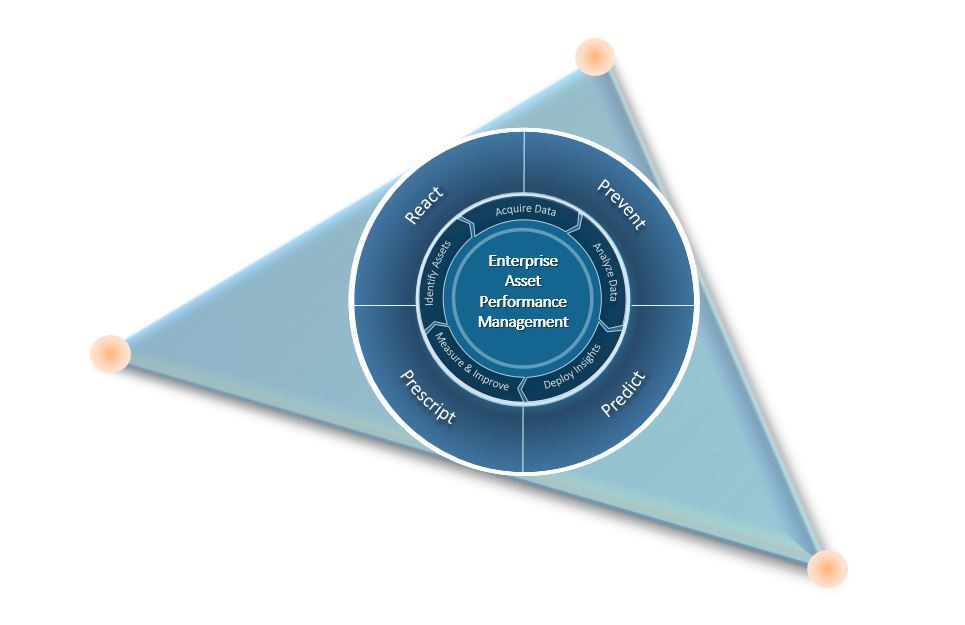

An asset performance management system for a global oil and gas company must address three primary business goals as represented by the three vertices illustrated in Figure 1.

The three vertices represent the business value propositions that underpin an optimization suite of data-driven analytical workflows. The iterative cycle implements a continuous improvement of measurement and analysis, transforming raw data into actionable knowledge

Outcomes of increased asset utilization:

- Improved reliability.

- Predict failures.

- Just-in-time repair/replacement.

- Higher asset operating efficiency.

Outcomes of improved process performance:

- Higher quality data.

- Repeatable, consistent maintenance results.

- Fewer person-hours wasted performing analysis.

- Increased understanding of data through visualization.

Outcomes of optimized maintenance:

- Efficient preventive maintenance schedules.

- Less overtime due to unexpected events.

- Accurate causal analysis.

- Effective corrective action.

Data-driven soft computing models, married with the experience garnered by engineers and geoscientists at each asset, provide the knowledge needed for an optimized asset portfolio.

The key components of an asset portfolio optimization platform:

- Data Model: Manage large volumes of both sensors and events data.

- Exploration: Graph multiple sensors, overlay events.

- Data Selection: Quickly subset for analysis.

- Analytics: Predict asset behavior with customized analyses via alert dashboard and reporting workflows.

Even though the most mature implementation of analytics in the industry is unquestionably in predictive maintenance, we still see reticence in widespread adoption. Why is there a caginess to use data-driven analytical models to enhance operations and prevent unscheduled downtime? It is the major threat to maximizing revenue. And in a climate that necessitates tightening the purse strings, we are in dire need of change.

We must use data analytics to fuel the decisions that optimize processes across a global asset portfolio. Technology and workflows have been prevalent for many years, and now the mindsets of people in the industry are rapidly evolving to adopt the cognitive and machine learning capabilities to climb out of this current trough and ride future peaks and troughs.

For more insights on how analytics can help optimize your asset portfolio, I recommend these SPE papers:

- Oilfield Data Mining Workflows for Robust Reservoir Characterization: SPE 149785

- Attitude of Collaboration, Real-Time Decision Making in Operated Asset Management: SPE 128730

- Enhance Digital Oil Fields by Plugging the Technological Capability Gap: SPE 127269

- Increased Upstream Asset NPV with Forecasting, Prediction and Operational Plan Adaptation in Real Time: SPE 133450