We often hear questions like: Are the shared service chargebacks to my business units’ cost centers accurate and transparent? Will I save any money by using a centralized shared service? Why should I consider a centralized shared service?

We often hear questions like: Are the shared service chargebacks to my business units’ cost centers accurate and transparent? Will I save any money by using a centralized shared service? Why should I consider a centralized shared service?

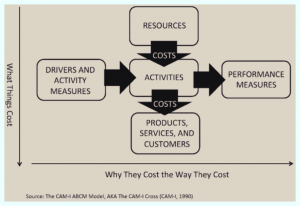

These are all good questions. To answer them, you need to understand your organization’s cost structure. That brings us to the age-old debate: Is traditional cost accounting sufficient to provide insight into what things cost and why they cost what they do? This in turn depends upon our ability to understand the root causes of costs as well as the cause-and-effect relationship between resources and outputs.

Many organizations today are exploring options to optimize services, particularly support and back-office services by addressing root causes of inefficiencies, including resource-sharing constraints and poorly aligned processes and supporting systems.

For example, IT services, call centers and order processing are typical candidates for process alignment and cost reduction initiatives. More complex organizations are even looking at sharing sales, field service and logistics operations across diverse business units. Many believe these improvements can be realized through the implementation of shared service centers.

Shared service centers are complex operations that require a new way of planning; they depend on consumers being willing to “give up control” of key support functions and rely on dependable methodologies and systems for tracking costs as well as enabling accurate, transparent chargeback rates. Intuitively, the consolidation of support services should improve efficiency, eliminate redundancy and duplication, and reduce operating costs, thus generating a return on the investment to consolidate. But how can this be validated?

Traditional accounting versus ABC (activity-based costing)

Activities are the very core of what a business does, and organizations need to understand how activities consume costs in an organization. Any moderately complex organization will be able to identify hundreds of significant activities, such as quality testing, call resolution, payment processing and a myriad of operational actions.

The age-old question is, “Why isn’t the method of allocation my organization uses sufficient for charging costs to the business units?” The answer, not surprisingly, is the same as why an organization should utilize an ABC model. It is because traditional accounting lacks visibility into the activities that drive costs. Costs are either allocated based on some arbitrary method (e.g. revenue) or they are assigned based on inaccurate drivers (e.g. headcount). When costs are properly allocated based on the deserved share of costs using actual consumption of the services in question, it’s easier to justify and is more transparent to an organization.

Inevitably when an organization decides that it is going to charge shared service costs such as information technology (IT) , procurement , or human resources (HR) back to business units, the unit receiving the costs asks, “Are they fair and based on reality?” It is not unusual that the business units getting hit with charges believe then to be inaccurate or do not understand the method behind the calculation of the charges. By using a comprehensive cause-and-effect cost model that presents costs in a way in which they are actually consumed rather than an arbitrary volume-based traditional account methodology, those discussions become more limited, and in the end, the charges are usually understood and accepted.

Inevitably when an organization decides that it is going to charge shared service costs such as information technology (IT) , procurement , or human resources (HR) back to business units, the unit receiving the costs asks, “Are they fair and based on reality?” It is not unusual that the business units getting hit with charges believe then to be inaccurate or do not understand the method behind the calculation of the charges. By using a comprehensive cause-and-effect cost model that presents costs in a way in which they are actually consumed rather than an arbitrary volume-based traditional account methodology, those discussions become more limited, and in the end, the charges are usually understood and accepted.

ABC/M in the shared services environment

Understanding the cost to perform the organization’s activities (and the root causes behind these costs) allows business managers to begin looking into consolidating common services across the entire organization (e.g. IT), eliminating departmental process redundancies (e.g. order processing), and leveraging economies of scale (e.g. field service). The key to success is ensuring that services are maintained at a level acceptable to the customers during and after the transition to the shared service environment.

Properly evaluating this change requires insight into the service’s cost, how it relates to the business unit(s), and whether it has any impact on product or customer profitability. However, many organizations often do not have this insight into what things cost and why they cost the way they cost. Different departmental consumption patterns are particularly important when evaluating future demands departments will place on the shared service to support long-term IT investment planning. For example, while the net dollar cost of IT resources consumed may be the same between two different functions, one may have high telecom and data communication costs, while the other may require larger data storage capacity. Using a cost management system supports this type of strategic decision-making by modeling cost consumption patterns and performance levels.

Many departments that perform back office functions provide services to one another (e.g. facilities, HR), and each organization’s costs are assigned to each other. This reciprocal costing is one of the most feared issues to tackle with a full absorption model; however, any costing solution must account for these reciprocal costs without double counting the costs when reporting them. Most commercial ABC systems will account for this, but beware when creating an in-house system, as these costs can sometimes be double-counted. It is important to be able to explain reciprocal costs and to be transparent about how they are passed between departments.

It goes without saying that whatever method is used, it must capture and incorporate the costs from other departments that are incurred during the execution of shared services, such as facilities, recruitment, payroll, etc.

Where to go from here

Ralph Waldo Emerson says, “Shallow men believe in luck. Strong men believe in cause and effect.” If Emerson was right, knowing the cause-and-effect relationship among costs is the key to understanding an organization’s business and how costs are consumed. In many organizations, when costs for shared services are charged to a business unit cost center, there is no transparency present to provide faith in its accuracy. Conversely, service providers are often left guessing whether they are recovering the costs to provide the service. A robust cost model with cause-and-effect relationships provides cost center managers clarity regarding those charges and gives confidence in the charge itself.

Learn more about finding the real costs of doing business.

===

This post is excerpted from the March/April Cost Management magazine article, “Does It Always Make Sense to Share? Costing in a Shared Services Environment,” co-authored by Tony Adkins and Bob Misch. The full article is available via subscription to Cost Management.