Does age matter? Perhaps not, but maturity certainly does. The level of analytics maturity, in particular, makes a big difference to the options open to companies, and the strategies that they can adopt to get best value from analytics.

A model of analytics maturity

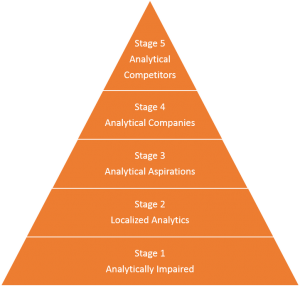

I like Thomas Davenport’s model of analytics maturity. It is simple enough to understand easily, but complex enough to support some theorizing. He describes analytics maturity as a five-stage pyramid.

The bottom is Stage 1, analytically impaired, where companies are unable to use analytics effectively. At Stage 2, localized analytics, there are clear pockets of good analytics practice, but they are isolated, and there is no overall strategy. By Stage 3, analytical aspirations, the company has started to see the benefits of using analytics, and may even have formulated a strategy for doing so. At Stage 4, analytical companies, the company has started to make good use of analytics in decision-making, and has ambitions to gain competitive advantage. The final stage, Stage 5, is analytical competitors. These are companies at the top of their analytics game, innovating in analytics and using analytical insights to give them a clear competitive advantage over their peers.

The pyramid structure makes it obvious that the largest group is the analytically impaired, with fewer and fewer at each intermediate stage.

Analytical maturity and strategy

So far, so good. But what exactly does this model tell us about strategy, and particularly, the strategic options open to companies at different levels? Stage 1 companies are largely unaware of the potential of analytics. They are therefore unlikely to select any strategy involving analytics, because it is just not on their radar.

Stage 2 companies, however, are starting to develop awareness. The pockets of excellence are likely to be led by people with analytics expertise. However, it is unlikely that any of them have been recruited for this expertise: far more likely that their knowledge is serendipitous. These companies are using the resources to hand, and not looking any further.

But as analytics awareness grows, and the company moves into Stage 3, so does the appetite for analytics within the company. People start to see the benefits of using analytical insights in decision-making. Increasingly, company strategizing relies on it. Now the company is likely to outgrow its internal serendipitous expertise. It needs to look for more. For the first time, the question will arise: do we recruit more data scientists, buy our own technology, and try to build our own expertise, or do we use an Analytics-as-a-Service provider?

There are many arguments on both sides of this divide, including company policy, whether the questions being asked are suitable for analytics, and the speed with which answers are required. Ultimately, speed is likely to be key: developing in-house analytics expertise can take up to a year, but if you buy in Analytics-as-a-Service, you are likely to see results within just a few weeks or months.

Being data-driven is about giving decision makers the power to explore data and make predictions. Help your business stakeholders with tips from this collection.

Many companies choose a hybrid model: they go for the best of both worlds. For the short term, and to see immediate benefits, they use Analytics-as-a-Service. But for the longer term, they start to invest in developing their own expertise, including both hiring the right people, and bringing in technological solutions.

By Stage 4, analytics is crucial to the company’s success. Any analytics that had been outsourced is likely to have been brought back in-house, and protected from outside influences. But here’s the twist. Quite a few analytically-mature companies—at least Stage 4, and often Stage 5—are engaged in outsourcing analytics work to external providers. Why? It’s a question of the level of the work.

By the time companies reach this stage of maturity, they have a lot of routine analytics going on. But they are also pushing at the boundaries of what is possible in analytics terms. Their best experts are spending their time working out how to innovate analytically. They don’t want to spend (or possibly, waste) their time on basic analytics that anyone could do. These companies therefore often outsource the routine work, to give their analytical experts time and space to work on the more interesting, and often more valuable, experimental stuff.

A question of degree

So maturity does matter. But the level of maturity does not dictate ‘to outsource or not to outsource’. The situation is far subtler, and more interesting, than that. Are you using Analytics-as-a-Service? What level of maturity is your company? We’d love to know whether this fits with your experience. In the meantime, read the free white paper “The 5 Essential Components of a Data Strategy”.