Whose mobile communications are hitting the spot? Which broadcast strategy helps banks make an emotional connection with their customers? Who sends out such badly targeted e-mails that customers see them as less personally relevant than a TV advert? The answer to these questions may surprise you.

Our recent survey of customers multichannel experience, ‘Pleased to Meet You’, provides the answer to these and many other such questions. We’ve just published two new research papers that specifically examine the marketing strategies of banks and supermarkets to find out what works for them, and where they need to try harder. They are now available for download here:

- Multichannel supermarket communications: what customers really think

- Multichannel bank communications: what customers really think

Unfortunately we don’t have the space inside this blog to go into all the findings from these papers, but at least we can answer the three questions above.

Whose mobile communications is hitting the spot?

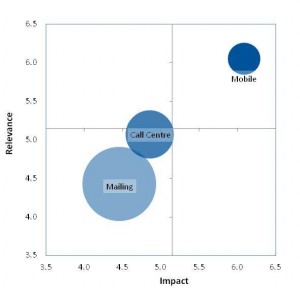

The surprise hit channel for Banks is their uses of SMS messaging. Many banks in the UK have started providing mobile alerts for everything from accounts approaching overdrafts, to checking against fraud. And the customers love it. In fact it is the only direct channel that the banks use which lives up to the promise of personalised and relevant communications designed to engage with the customer and build brand satisfaction. Sadly the same cannot be said of banks direct mail efforts which are generally somewhat less well received.

Which broadcast strategy helps banks make an emotional connection with their customers?

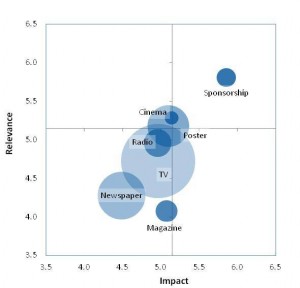

Of all the broadcast channels that banks employ, only one really seems to hit home, and then only to a relatively small audience. And that strategy is sports sponsorship. At the time of the survey a major international rugby tournament was underway, and this registered a significant presence in our survey. Whilst rugby was the event that showed through at the time of the survey, it would be quite reasonable to assume that fans of other sports would be equally likely to derive an emotional attachment to their banks, mobile phone companies etc as a result of sponsorship of other sporting events. Interestingly, the segment of customers for whom sponsorship worked were also the segment most antagonistic to other channels, so for those customers this forms an important channel.

Which sector sends out such badly targeted e-mails that they are seen as less personally relevant to their customers than a TV advert?

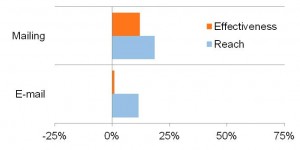

Shockingly supermarkets, the masters of direct mail, do not appear to apply the same disciplines of personalisation and targeting to their e-mail communications. The performance gap between these two theoretically similar channels is dramatic to say the least. Whilst e-mails are seen to be a cheap form of marketing, it is doubtful that a strong incentive to improve performance in these areas. But faced with declining open rates, and the raising of other e-mail barriers, maybe we need to understand that the cost of poorly targeted e-mails lies in the damage it does to our relationships with our customers, and that is too valuable an asset to so lightly disregard.

I hope you found these snippets from the research interesting. I would encourage you to download the two papers as there is much more insight contained within.

This research was carried out in partnership with Professor Hugh Wilson of Cranfield School of Management and MESH Planning. The initial findings, including a fascinating behavioural segmentation of customer preferences, were published in ‘Pleased to Meet You: How different customers prefer very different channels.’

1 Comment

Hi. Just a quick note to let you know that I truly appreciated this post. I have been looking for this kind of information. Keep up the good work!

Canvas Bags