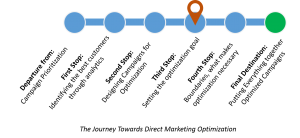

We are now in one of the most interesting stops in our journey towards marketing optimization. We have been talking about optimization on the assumption that we have an optimization goal, however, as strange as it might sound, companies do not always know the overall goal of their direct marketing activities, much less how to measure the results. Although the ultimate objective is usually to sell more, doing that does not always deliver the highest profit for the organization. In fact, each campaign usually has its own objective and when combined together they might even have contrasting objectives.

In the first post, “The Journey Toward Direct Marketing Optimization” I explained, through a very simple case, how to maximize the expected profit, where:

Profit = probability of response * offer value

Then I covered how to measure the probability of response in my second post, “First Stop: Identifying the best customers through analytics.” Now we'll address what we can optimize and what information we need in order to do so for the second part of the equation.

Maximization

Almost every company does direct marketing campaigns in order to increase sales, profit or revenue. The optimization goal in these cases is to maximize one of these measures. However, most of these companies don't actually know the income that they will get from a customer if he/she accepts the offer.

The optimization process will make that determination better if we can measure each customer/prospect we are targeting. Exactly what that means depends on the industry we work in and the type of products/services we are offering:

- In telecommunications, incremental ARPU (average revenue per user) is a common measure that shows the extra value a current customer will bring if the offer is accepted. Incremental ARPU is relatively easy to calculate for plan upgrade campaigns, but more difficult for other type of offers.

- At some banks we have worked with, we have used the Net Operating Income (NOI) of a customer as a measure to maximize. However, measuring the incremental NOI as a result of a certain product is a very difficult task, so we use the current NOI.

- In the Insurance sector, one of the typical ways of valuing a customer is by doing a Customer Lifetime Value (CLTV) model. Then we can use this number in order to set a value for the campaign we are doing.

- In Retail optimization, it is easier to calculate the value of a campaign if the offer is a specific product, because in that case it's the product's price x units sold to calculate the impact. In other industries or other scenarios, offer values are a bit more complicated to calculate.

Minimization

Although is more common to set maximization goals, it's also possible to have minimization as a goal. One of the most frequent measures to minimize is the cost of the campaigns. If we have several campaigns and different channels to use, we could choose to minimize the overall cost of all campaigns. We all know that an email campaign is much cheaper than a call center campaign, but probably contacting the customers by emails is less effective. So we may want to have a balance between cost and expected response, which is possible by setting constraints. We will come back to this topic at the next stop in our journey.

Like for the maximization goals, the type of measure we need to minimize varies by industry. For instance, it is very frequent in the Banking industry to try to minimize the overall risk. If we are offering risk products, like loans or credit cards, we can measure the risk of the customer and try to minimize the overall risk of these campaigns as a goal. In the Retail industry, many campaigns can be discount offers, so we could need to minimize the overall discount we are giving to our customers.

Combined Goals

Sometimes one single optimization goal is not enough and we need to set secondary objectives. Going back to the risk example in banking, our main objective could be to maximize profit, but to minimize the risk of the offers. In most industries, a very common goal is to maximize revenue and minimize cost, and it's important to note that by maximizing profit instead of revenue, the outcome minimizes the applicable costs.

Controlling this in a prioritization process is certainly very complicated. SAS Marketing Optimization can work with two optimization goals in order to calculate the best result for both. This is of course more time consuming as a simple optimization, but very easy to perform through our software.

Whichever the goal is, we need information to use as an input in the tool. Yet, as said before, it is not imperative to have perfect information in order to optimize campaigns. Like with probability scores, we have alternative ways to measure the results. With the customers we are working with, generally the value is set by offer and not by customer. This is already a step forward as most prioritization processes do not consider this when selecting customers.

If choosing any customer as a target will produce the same results (they all have the same value), then the probability of response becomes more important to differentiate among the customers. If the probability of response is not a predictive model but an average response rate for all the customers, then constraints and contact policies will be more relevant to define the optimized solution.

Constraints and Contact Policies are in fact our next stop in this journey. If we could do whatever we wanted, without restrictions, then this journey towards marketing optimization would not be necessary. Therefore, our next stop is the key to understanding optimization. I invite you to keep on travelling together. We are very close to our final destination: Optimized Campaigns!

Editor’s note:

If you did not read the previous posts in this series, I encourage you to do so since Luciana planned them as a step-by-step journey. Marketing optimization is a very effective way to tie overall business objectives (often profitability) to marketing campaign activity because it mathematically calculates the best aggregate outcomes based on how you define them. If you'd like to dig a little deeper into how marketing optimization could work for you, I suggest you download this whitepaper, Improving Multichannel Marketing with Optimization. Among other useful content, it includes a practical checklist of seven steps to optimize your marketing.

1 Comment

Pingback: Optimization step 5: putting everything together - Customer Analytics