This is the sixth of the seven parts of blog post series “A practical guide to tackle auto insurance fraud”.

This is the sixth of the seven parts of blog post series “A practical guide to tackle auto insurance fraud”.

In the first five articles of the series we drilled down to Data Management and Data Quality as the basis for fraud detection analytics, to Business Rules and Watch lists techniques that play always a crucial role for claim handlers and fraud investigators, to Advanced Analytics which add a layer of defensed towards the unknown fraud typologies that more experienced and organized fraudsters utilize, to the most powerful advanced analytics technique of Social Network Analysis for uncovering hidden relationships between all involved parties and entities in a claims and not only process and to Hybrid Scoring in order the insurer to be able to combine all of the above techniques and intelligence in a fraud risk scoring process.

This 6th article of the series gives a practical guideline of what functionalities and visualizations a claims fraud Investigator should have, for assisting the most in a fraud investigation and detection process.

Interface Key Areas for the Fraud Investigator

All analytics intelligence, business expertise, predictive models, social network analysis, will be without practical value if at the end a specialized graphical user interface focused in claims fraud detection, exploration and case process handling, is not available for claims handlers and fraud investigators.

The key areas of such interface are:

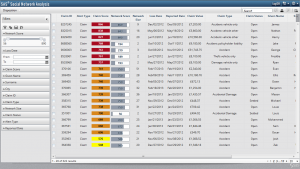

A. Claims Alerts and Fraud Risk score prioritization

Investigator must be able to easily view the high fraud risk scores, in order to focus his time and energy to claims that really matter. Functionalities such us shorting of claims based on risk score or for filtering for a specific claim value threshold, time period, agent, body shop etc. are important, so the investigator can access fast and easily cases of interest.

Claims Alerts and Fraud Risk score prioritization

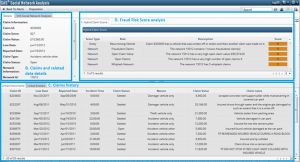

B. Claims and Related Data details

Investigator should have a holistic view of each case, and this means that access is needed not only to specific claim data, but to all other related data: policy data, underwriting, connected parties, shared data from insurance association for policy holder or vehicle, google maps or even street view for the place/address of accident, public telephone directories data etc.

C. Claims history

The history of policies and claims of the claimant and all other connected parties is major importance for a fraud investigation process. Even if a claim looks legitimate, its connection with a past suspicious fraud claim triggers also suspicious for the new claim, and more thorough review and if needed investigation is mandatory.

D. Fraud Risk Score analysis

Each fraud risk score should be analyzed in the individual scores that is being constructed with details for every rule that is violated, so the investigator gets a quick view of the facts that characterized the specific claim like suspicious.

Claims data details, history and score analysis

E. Social Network Analysis Visualization

Such graphical interface will easily preview, identify connections in fraud rings and hidden relations between claims, policy holders and other connected parties (body shop, lawyer, medical provider etc.).

Social Network Analysis Interface

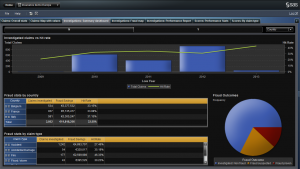

F. Visual Data Exploration and Reporting

Investigator should be able to perform visual data exploration in order to analyze holistically claims behavior (e.g. per body shop, agent/broker, claim handler, investigator etc.), so to uncover anomalies and hidden fraud suspicious insights.

Additionally predefined reports and dashboards are needed to be monitored, with fraud detection key performance indicators, so further analysis and actions to be triggered for cases that not optimum performance is indicated.

Visual Data Exploration and Reporting

Key message

While applying a series of analytics techniques in a fraud detection process and having a hybrid score for every claim, it is important the fraud investigator to be able to access data fast and easily, visualize instantly cases that need his attention, have all available information in one screen (including related historical data) and be able to further explore and analyze hidden relations with social network analysis or apply visual data exploratory techniques for uncovering suspicious fraud insights and anomalies.

Specialized fraud prevention software needs to include such a highly specialized investigator’s interface, as this will boost investigator’s efficiency, provide optimum fraud detection results and at the same time minimize the time, resources and costs of the investigation process.

This is the 6th post in a 7-post series, “A practical guide to tackle auto insurance fraud”. This series explores 7 analytics best practices techniques that insurers need to follow for tackling auto insurance claims fraud. Next post is the last one of the series and deals with the Operational Processes and Automated Controls, a consulting approach and proposition for applying high end fraud detection technology in your organization, via embracing and enhancing your current claims handling and fraud detection operation procedures and applying automated controls in order to secure that no money will get out of your door in highly suspicious fraud cases.

5 Comments

Pingback: A practical guide for auto insurance fraud – Opening Welcome - Bright Da

Terrific writing on arbitrary topics. Im trying to currently

accomplish something similar to what you have here except on

a different topic totally. Thank you for the motivation to

write better content.

Thank you for your nice comments !

I enjoyed visiting your webiste. I leave comments rarely, but

you definately up deserve a thumbs!

Thank you ! Very nice to read so nice comments from investigation experts ! Have a nice weekend !