I wish this were a blog about a new super-affordable airline, but instead capital flight is the illegal movement of money from its country of origin, transit or destination. This movement of money through facilitators is creating a hyper-breed of criminal enterprise using the regulations of the world’s financial systems as the rules of a money swap game.

Capital flight is not limited to developing countries but is a staple of the worldwide financial system that all of us operate in on a daily basis. Not simply an economic development issue, this has become an issue of national security and country stability.

The fact is this, money can't move on its own. It needs a person that not only executes the movement of money in billions of transactions around the globe, but in many cases serves as the criminal’s advisor on how to do it. So who are these mythical creatures that come out of the woodwork to help? If you said bankers, lawyers, jewelers, couriers, escrow agents, title and real estate companies, you would be correct. In many cases the country itself, through weak laws that foster the creation of blind shell companies, can help facilitate these activities.

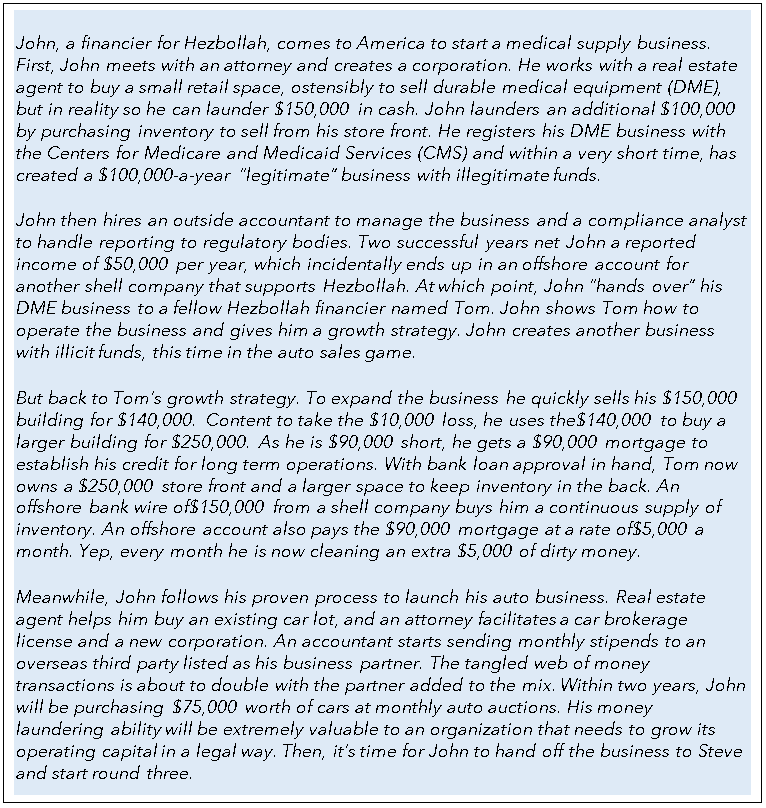

So what can be done about it, not strictly from a regulatory framework perspective but from a technology one? Technology can bring transparency to transactions, revealing the connections between the people conducting them to identify facilitators. The following scenario illustrates a possible capital flight and facilitator scheme:

I share this long, convoluted story to show how, with patience, the system can be easily circumvented. John is an entrepreneur building a financial network that supports a terrorist organization. Imagine being the investigator faced with the daunting, time-consuming task of piecing together this scattered paper trail with its disconnected dots.

This is where network, or link, analysis and advanced analytics can change the game. Analytics reveals the linkages to transactional “dots” that manual processes just cannot produce effectively.

Big Data vs. Relevant Data

The government, along with the rest of society, is currently going through a data revolution. There is more data available on every subject than ever before, and that includes capital flight. The government is a voracious data collector, but struggles with how to sort it.

The volume, variety and velocity of data will keep growing, increasing the gap between big data and relevant data that can be used to identify “capital flight facilitators”. Government organizations without advanced analytics will face an information overload that will increase time to detection and action, making it easier for “bad guys” to exploit the system, just like John and Tom above. Law enforcement agencies need tools and systems to connect all of the relationship and transactional dots within the relevant data. They need the best information to guide their decision making in a short period of time to thwart terrorist financing activities. So how do agencies accomplish this task?

Managing data to make analytics possible

Luckily for government agencies, improving data management will not require a database overhaul or a massive central data warehouse. Instead, agencies need a data integration layer that can connect disparate databases across the agency, department or other federal, state and local government entities. A single layer can link data stored across platforms, providing access and analytical functionality from a centralized location.

Envision what this could mean for the law enforcement agent tracking John and Tom as capital flight facilitators. At his fingertips he would have a comprehensive set of data pulled from multiple sources into a single solution that provides link and geoanalysis on people and financial transactions in near real time.

Agencies need to ensure that the data being analyzed is cleansed. Data quality includes automatically correcting nonstandard or duplicate records and unknown data types. It includes entity resolution, which more accurately identifies individuals across data sources. Fraudsters, like John and Tom, often provide inaccurate, incomplete or inconsistent information that prevent record matching across systems. But with entity resolution, an agency could know, for example, that the John Williams in one database is the same person as the J.P. Williams in another.

Finally, to successfully analyze vast amounts of granular transactional data, this data infrastructure must be able to:

- Process large volumes of data quickly

- Handle the huge variety of data involved, including tables, documents, e-mail, web streams, videos and more

- Manage the velocity of data, which is increasing rapidly

All this is done with proper data governance in place, ensuring that the data is used only as legally authorized and intended. Cyber security, audit trails, roles-based permissions and other governance functions support the appropriate handling of data.

Analytics is crucial to keep up with the growing sophistication and complexity of fraudsters and terrorists looking to enter the country, or move illicit funds through facilitators to finance terrorist activities. The right data management, integration and quality infrastructure must be supported by a strong business analytics foundation.

Reducing Errors

People that serve as facilitators and who want to get into the country, or who are already in the country, can forge records, manipulate data and introduce confusion into the process to hide illicit funds, as described in the scenario above.

Analytics can take all available information to look for financial transactions tied to facilitators. Law enforcement agents can use this information to look for red flags and make quick determinations if a person should be allowed to enter the country or if their financial transactions need further review. Analytics helps make this process more accurate and efficient for everybody involved.

Ultimately, analytics connects the dots that link Tom to John, and John to Steve, and to five other individuals that weren't even mentioned in this story. There are billions of transactions happening around the world each day. This scheme started with only $250,000 of dirty money. Yes, the regulatory framework could be improved, but analytics are key to revealing suspicious transactions and the frequent facilitators who would fund attacks on America.

This article was co-authored with Ricky D. Sluder, Certified Fraud Examiner, and Principal Solution Architect in the Security Intelligence Practice at SAS.