Hippocrates once said, “Let food be thy medicine.” For food vendors, this advice could be communicated another way: Stock more fresh fruit, protein and vegetables. The periphery of the grocery store has led in the expansion of revenues – namely within produce, but also spanning seafood, bakery products and ready-to-eat fresh cut and prepared foods.

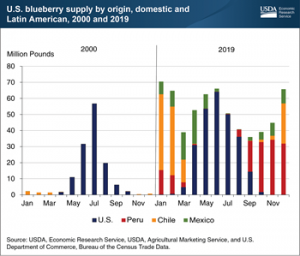

For example, US production of blueberries has grown 284% since 2000, but blueberry imports have grown 1177%, allowing grocers to stock this premium fruit all year long.

While this might sound like great news, growing this kind of value is harder and more costly than manufacturing nonperishable staples like peanut butter or corn flakes.

Growing fruit and vegetables falls upon a shrinking cohort of specialized agronomists who grow their produce within even more specialized microclimates well-suited for high value crops. That’s part of why California – with distinct agriculturally-friendly bands of Mediterranean climate zones – produced four times more lettuce in 2019 than all indoor produced veggies in the US.

A nomadic harvest

As companies continue to scale their supply chains for these high-margin, fresher and healthier foods, global packing houses must take harvests in from regionally distributed specialized producers to keep the flow of fresh produce going year-round. Examples include the lettuce belt, which runs from Salinas, California to Yuma, Arizona, or the strawberry belt, which extends from California down into Mexico. Successful operations span the globe to secure a constant supply for their clients.

The bad news is that high value crops like these are accompanied by higher costs of production, inventory storage, processing and transportation. Quick in-store turnover and flexible supply chains can help drive solid business decisions as harvests migrate with the seasons and variable consumer demand.

Worse still are the waste figures and the outlook for the value-added supply chain still recovering from the pandemic and weather-related supply shocks such as paper box shortages or transportation misalignment. These events may cause farmers to plow perfectly good harvests back into the ground. But, even before the recent shocks to supply, the USDA estimated that more than $161 billion worth of food is discarded by US retailers and consumers each year. This has led to food waste filling landfills, creating excess greenhouse gas emissions (especially from methane) and to businesses wasting money on fresh water, facilities, staff and energy for processing, storage and distribution.

Waste costs more and loses customers

Eighty-one percent of global consumers plan to buy more environmentally-friendly products over the next five years and discerning shoppers plan to pay special attention to sustainability in food. According to Randi Kronthal-Sacco of NYU’s Stern Center for Sustainable Business, just 16% of all new consumer packaged goods (CPG) products – those with verifiably sustainable attributes – drove 54% of new business.

The inefficiency, emissions and pollution are not only bad PR – they also cost major food companies millions of dollars in lost revenues every growing season.

Is this waste necessary to supply fresh produce at scale? Not necessarily. According to Accenture, 63% of CEOs see technology as a solution to accelerating their sustainability efforts. That’s why SAS has developed analytics that increase efficacy in sourcing, processing, distributing and selling fresh food – because when a brand’s high sales performance can be achieved sustainably, everyone wins.

Solution #1: Forecast your production

Connecting the first mile of production with agriculture analytics helps food companies capture historical performance of growers and build a comprehensive dashboard that allows them better control over production: volume, timing and quality. The more farm-level data can be incorporated into the buyer’s view, the greater accuracy of short- and medium-term production forecasting.

SAS’ forecasting techniques can identify key weather changes that trigger changes in crop yields. Those same solutions can also integrate both historical data and IoT sensor data to better forecast production and help make sourcing decisions in advance.

Solution # 2: Forecast your demand and refine retail delivery

Syncing crop yield and your purchasing contracts to demand signals is the next logical step to reducing supply inefficiencies. In this approach, manufacturers can now answer questions like, “How much do I need?” and, “How much can we produce?” This creates an end-to-end view to match the two work streams.

At SAS, historical transactions and attributes, like weather and holidays, improve both seasonal plans and customer service. Visit the SAS Supply and Demand Planning page to learn more about how SAS helps retail, consumer goods and agriculture brands plan for the future.

Complementary to this, SAS can even help retailers move toward their zero waste goals through smart bundling, segmentation and product placement strategies. Using analytics to surface time-sensitive sale opportunities, retailers can drive customers to snatch up fleeting opportunities for a low cost mix of soon-to-expire produce. All retailers and CPG firms need to heed the lessons from a slew of startups (like Imperfect Foods) presenting this throwaway produce as an eco-friendly alternative -- or risk losing market share.

Analytics can, and must, be used to influence pricing, marketing and product mix decisions that turn waste into cash flow. In fact, a large grocery client used SAS for Demand-Driven Planning and Optimization to help the chain reduce food waste while more closely meeting customer demand. This is just one example of how we work to create efficiency, sustainability and a healthier bottom line.

Solution # 3: Optimize your logistics

Order optimization depends upon your ability to manage a complex, and often international, supply chain. With the above solutions for better production schedules and inventory availability to match demand, adding optimized logistics completes the trifecta of analytics for perishable products. SAS supports transportation planning, with cold chain enhancement and monitoring allowing you to synchronize logistics and to be on-time-in-full. Furthermore, through our logistics partner CH Robinson, sustainability can be taken a step further with discrete greenhouse gas measurements for loads via Emissions IQ.

A double bottom line secures the future.

Advanced, predictive production and demand insights connected by optimized logistics allow you to achieve sustainable efficiency. Visualizing the entire supply chain gives you unique opportunities to react responsively to your customers more quickly than your competition. You will have new opportunities to optimize a data-driven view that can help you reduce inventory and cost of goods sold across owned and leased facilities and transportation. It means setting the stage for data-driven operations improvements– including better planning for labor and processing, while reducing unexpected costs and manual efforts. But, most importantly, it means credible sustainability in providing nutritious food.

To learn more, download this free white paper Four Elements of Sustainability Analytics.