Many people love waking up to a mug of hot coffee every morning (medium cream and a bit of sugar, please). But how many have thought ahead to when that wake-up cup of coffee might be harder to come by? Predictions show that weather patterns tied to climate change are starting to damage Brazil’s coffee business. High temperatures and sporadic rains – which can spark fast-spreading fires – could wreak havoc on picky coffee crops that need precise levels of temperature, humidity and sunlight to thrive.

That’s bad news for coffee lovers. Brazil produces 32% of the world’s coffee.

Some experts project that by 2050, rising temperatures will reduce Latin America’s “coffee belt” by up to 50%. As the coffee-growing region shrinks, the coffee belt may shift to a new location – disrupting lives and economies along the way.

All types of farmers face climate change risks, of course. A single severe weather event can wipe out land, animals or crops. The strain on livelihoods can devastate small businesses, families and entire communities. There are numerous business risks involved down the line, too. In the coffee business, for example, traders, roasters, retailers and financial institutions are all affected.

With the bigger picture in mind, coffee-loving sleepyheads have little room to complain.

Climate change: Broad implications

The coffee industry is just one type of business that’s being forced to adapt to a changing climate. On its current trajectory, climate change will alter the landscape for countless individuals, cities, business leaders, governments and economies. And it’s likely to happen sooner than we think.

The earth’s temperature increased by about 2 degrees Fahrenheit in the 20th century. And experts in climate science say global temperatures will rise between 2.5 to 10 degrees over the next century, thanks to greenhouse gas emissions.

There are many examples of extreme weather events affecting different regions of the world. Think of vast wildfires across Australia. Deadly heat waves in Europe. Massive glacier melts that destroy entire ecosystems, such as Glacier National Park in the United States. And cities like Venice and Osaka that may disappear by 2100 if sea levels rise an expected 1 to 8 feet.

The toll on people and businesses

Along with visible effects in nature, climate change imposes human tolls. Think about the effects of extreme heat, for example. Studies have shown that crime rates increase and productivity slips in extreme heat. High heat literally keeps us from thinking clearly and alters our behavior.

In terms of employment, people are more likely to change jobs if they work in severe, high-heat conditions for long periods of time. That could mean moving to a new location to do similar work. Or, being out of work if there are no other options.

Physical structures are negatively affected by climate change, too. Consider the physical damage natural disasters like hurricanes can cause. If weather becomes too unpredictable or causes too much damage in one location, businesses may not be able to justify rebuilding. Or their insurance may not cover the cost. Some businesses will shut down operations in regions that suffer from extreme weather events. And new businesses will be hesitant to locate there.

Everyone will suffer from climate change eventually. Unfortunately, those most directly affected today tend to be people in lower-paying jobs – often in economically fragile areas.

The effects of climate change across industries

Looking at some cross-industry examples highlights the far-reaching impacts of climate change.

- Manufacturers. Some manufacturers, like paper or pulp companies, are water-dependent. When there are unexpected droughts and water shortages, entire plants may have to shut down – short term or long term.

- Retail. Retailers contribute heavily to carbon emissions due to their links with manufacturing, shipping, supply chains and physical stores. They are under intense pressure to adopt emission reduction strategies. Some consumers refuse to shop at retailers that haven’t adopted sustainable practices. Investors consider environmental, governance and social (ESG) issues, too.

- Health care. Medical systems can be fragile when hit with unexpected surges. During extreme heat or natural disasters, staff and facilities could be overwhelmed by people who are injured or suffering from heat-related illnesses.

- Insurance. Insurance risk relates to liability – and knowing who to hold responsible for a loss. Insurers will soon see more individuals and businesses seeking compensation for losses related to climate change.

- Banking. At its core, climate change is a structural change – something that alters the way an entire market or economy functions. With the tight connection between economies and financial systems, climate change is a major source of financial risk. As such, it threatens global economic stability.

Naeem Siddiqi, Senior Advisor for Risk Research and Quantitative Solutions at SAS, says all businesses need to pay attention to climate risks. “For any business, climate change will affect costs related to carbon taxes or more frequent disruptive weather events that drive up the cost of goods. It will impact loans, repayment on loans, insurance risk, insurance premiums, equity markets and bond markets.

“All companies need to be sustainable,” he adds. “They need to do the right thing to attract customers and employees. Not acting on climate change may make it harder to hire good people and build market share.”

“Ultimately, companies need to think about the future,” says Peter Plochan, Business Solutions Manager for Risk at SAS. “They need to ask: How will climate changes or shifts in public opinion in 5 or 10 years force a change in business strategy?”

Industry snapshot: Why banks are so concerned

To examine climate change business risk from the lens of one industry, consider banking. The World Economic Forum identified climate action failure as the most impactful and second most likely long-term risk in The Global Risks Report 2021. It’s notable that the top five long-term risks in its 2020 report were also linked to climate change. And due to a lack of climate resilience, the EIU predicts the economy will be 3% smaller in 2050.

It’s not just something to anticipate for the future. Environmental changes have already caused financial losses for banks – and are bound to cause more. For example, farm loans sometimes aren’t repaid because of extremely dry weather resulting in poor crop yields. Some debtors struggle to repay loans because they face steep environmental fines. Others live in regions that are routinely overwhelmed by extreme weather events.

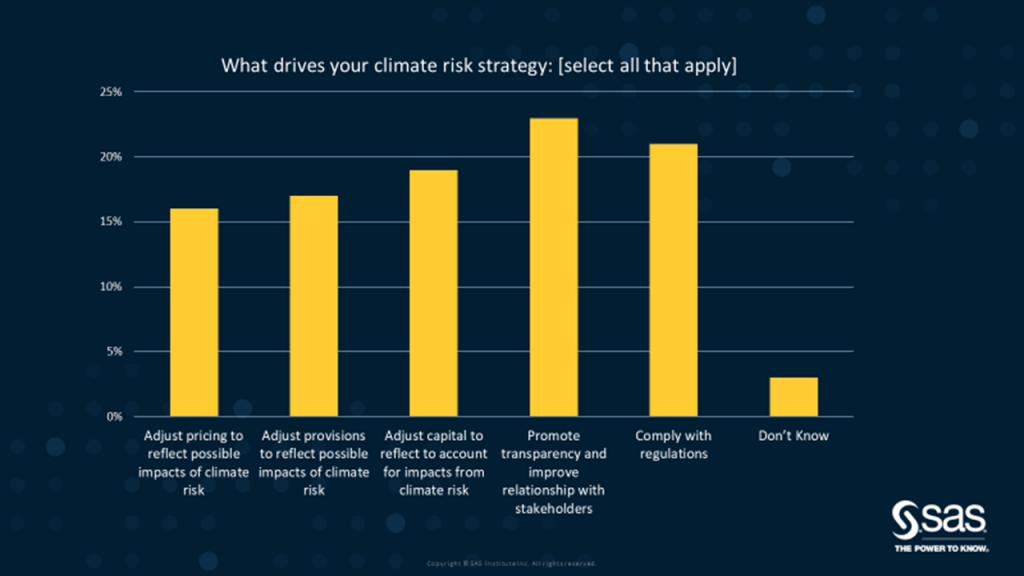

Financial risk – coupled with the desire to adopt greener policies and practices – is creating new demands from banks’ boards, investors, customers and regulators. Customer satisfaction and reputation are on the line, with full disclosure and transparency expected.

Considering regulatory requirements and the increased need for transparency, it’s no wonder financial institutions are busy developing detailed strategies for how to manage climate change business risks. Core to financial systems and economies, banks must learn to balance a range of high-stakes climate change risks and opportunities.

One way to approach it, Plochan says, is to take a long-term perspective and develop a strategy that considers the specifics of each counterparty and exposure. Can you continue as you are now, or do you need to act differently? Banks can start by thinking about climate change business risk in their own portfolios. Then they can begin asking borrowers to explain their exposures to climate change, and plans going forward. Because it will be difficult for boards to ignore the topic.

How do banks assess the financial risks of climate change?

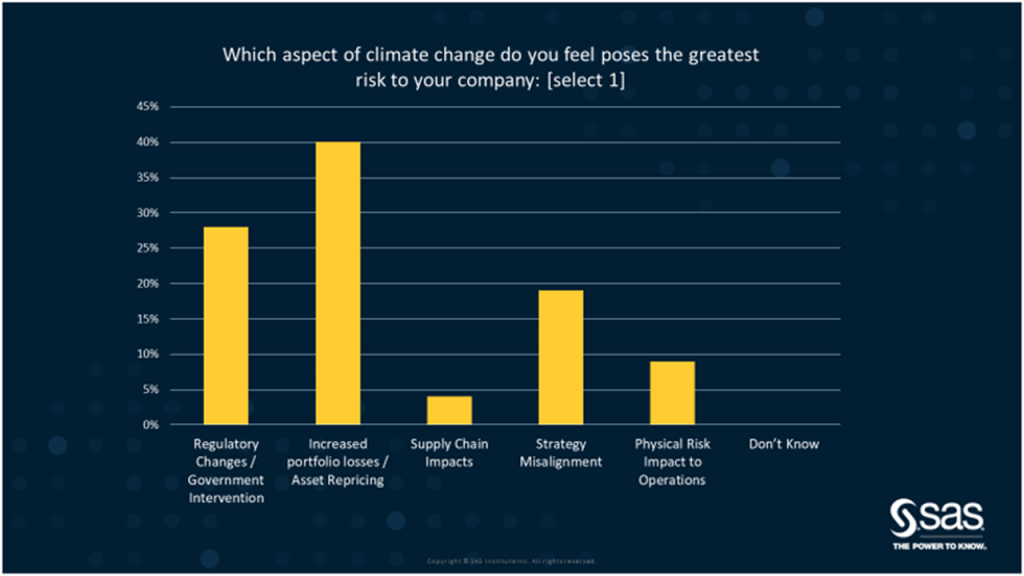

The Network for Greening the Financial System (NGFS) recommends embedding climate change risk management into existing enterprise risk management (ERM) frameworks and processes. In describing how to assess climate change risk exposure, the NGFS framework states that climate change can result in physical risks and transitional risks. Examining these categories helps banks analyze their climate-related risk.

- Physical risks – either acute or chronic – create financial losses directly tied to increasingly frequent and severe extreme weather events. Acute risks are one-off events that happen due to extreme weather. Chronic risks occur due to gradual climate changes that damage property or have other effects over time. Such events often lead to subsequent events, like supply chain disruptions.

- Transition risk refers to the financial losses banks experience as they transition to working in a lower-carbon economy. Losses in this category can be triggered by things like new climate policies, changes in technology, or shifts in market sentiment and preferences.

According to Plochan, it’s important for banks to assess:

-

- Loan and customer portfolios. This entails looking at borrowers’ financial stability and exposure to the changing climate. Climate risks would manifest as increased credit risk for the banks. Potentially, this could mean that a bank might not make a 30-year loan for a property prone to risk from rising sea levels. Instead, they might agree to extend a 10-year loan on that property.

- Banking operations. This involves looking at branches – and data centers – that are exposed to severe changes in weather. It also entails considering the negative effects of regulation changes that could result in penalties. In these cases, climate risks manifest as operational, strategic or reputational risks.

The complexity of assessing climate change financial risks

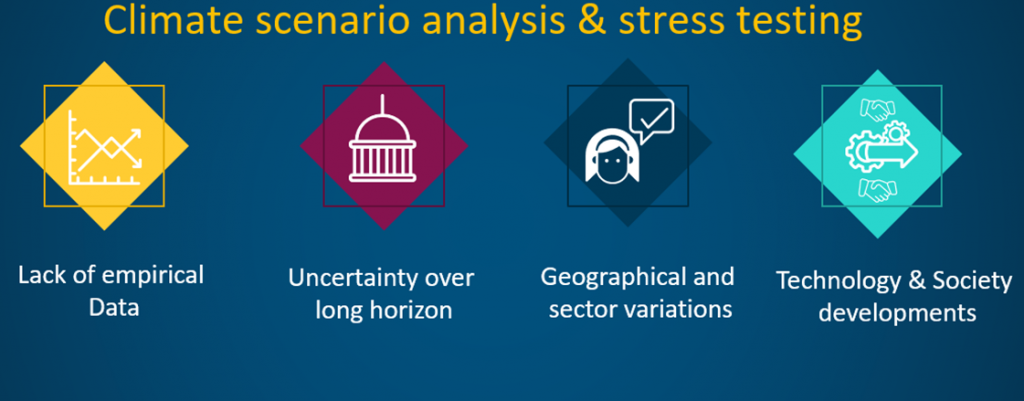

Accurately assessing the financial risks of climate change involves determining the effects of multiple climate pathways over several decades. The task is complex because there’s a lack of historical data to use in the analysis – coupled with uncertainty over a long horizon. That makes it harder to specify meaningful scenarios, develop good models and interpret them. There are also numerous geographical and industry variations, so cause and effect vary. And new technology and societal developments (renewable energy, lifestyle changes) happen all the time. Keeping pace requires new data and new methodologies.

While there are always uncertainties in predicting numbers over long horizons, the direction of this trend is definite. Things will get worse. And even though it’s challenging to predict a specific cash flow number 50 years from now, that should not deter us from acting today.

One way for banks to perform scenario-based risk analysis or stress testing, Plochan says, is to assess climate change exposures in their portfolios so they can link global temperature rises and other climate-related factors to macroeconomic aspects. For example, they can consider the impact on GDP across different segments. Then they can translate these into direct impacts on credit risk in their portfolios using their existing credit risk management frameworks.

But climate change is not only about risks. When we consider transition risks – such as reputation risk – we should recognize the new opportunities that arise. As Siddiqi says, “There are going to be big opportunities. For example, renewable energy, carbon capture, better batteries, and other technologies we haven’t thought of yet. There is a massive, sustainable future out there.”

Follow the banks: Incorporate climate change risk into strategic planning

Risk management technology provides tools to help us fight back against – and learn more about – climate change business risks. Using risk assessments with analytics, banks and other businesses can:

- Identify what and where the problems are.

- Measure and disclose climate risk exposures.

- Plan how to mitigate short-term effects of climate.

- Predict, plan for and potentially alter long-term effects.

- Identify opportunities for increasing revenues – and supporting a sustainable future.

Many in the banking industry are already using risk management technology to understand and respond to climate change as part of their broader risk assessments and strategic planning. Other industries can benefit by following this approach to respond to the business risks of climate change.

Climate change: More than just a business risk

Climate change affects us all. Some projections show that climate change could push an additional 100 million people into poverty by 2030. Those affected often lack the means to make changes that could alter the path of climate change. The onus is on wealthier, more technologically savvy countries and businesses to step up and do everything possible to steer us to a more sustainable future.

Policy guidance at national and international levels is needed, along with global cooperation. There are promising signs in this regard. For example, there are discussions about setting up a global sustainability standards board. And the US recently recommended principles for accounting for the impact of climate by measuring the “social cost of carbon.” This method would produce monetary estimates of economic damages associated with increased greenhouse gas emissions – and provide a way to meet targets set by the Paris Agreement.

As a central player in economic systems, banks are primed to set an example of how to respond to climate change business risks. That starts with their own operations and extends to helping customers understand their climate stance and risks.

Many financial leaders around the world have already committed to the goal of net zero greenhouse gas emissions – that is, carbon dioxide emissions – by 2050 or before. That’s in line with ongoing efforts to keep global warming to a minimum. These same institutions support investing aligned with the goal of net zero emissions.

As Siddiqi puts it: “Companies need to ask themselves: What can I do to be better in 10 or 20 years? Essentially, that means adopting best practices for sustainable behavior. And it means taking more individual responsibility for our actions. First, companies need to plan to be green, to reduce their own carbon footprint. Second, they need to identify and calculate the business risks they face due to climate change. Right now, the cost of doing nothing is probably cheaper than doing something. But not doing anything today will cost a lot more in the long term.”

The cost of inaction would certainly be high for businesses. It would be immeasurable in terms of the implications for humanity.

Learn how SAS is addressing climate change business risk