When it comes to forecasting new product launches, executives say that it's a frustrating, almost futile, effort. The reason? Minimal data, limited analytic capabilities and a general uncertainty surrounding a new product launch. Not to mention the ever-changing marketplace.

Nevertheless, companies cannot disregard the need for a new product forecast (NPF), or neglect developing an NPF process. This is especially true during the commercialization stage. New product forecasts drive a variety of multi-functional decisions during pre-launch preparation and product launch, including manufacturing decisions on raw materials procurement, manufacturing schedules, finished goods inventory and planning for sales and marketing support (marketing programming).

New product approaches using structured data

One approach to NPF is to add “structure” to the use of like product analysis, meaning the forecast is based on the launch behavior of similar products. Another approach is “structured judgment” incorporating statistical analysis of historical data along with guided judgment.

Companies are finding that structured analogy forecasts tend to be more accurate than unaided analogies, particularly in situations where experts have direct experience with their closest analogy.

Structured analogies can be enhanced through data mining techniques, which can more effectively identify candidate products that have similar attributes and characteristics. These candidates are “filtered” to yield a set of surrogate series that has the most similar statistical properties to the unknown new-product series. Since each process step requires both statistical and judgmental analysis supported by technology, a formal approach to combining statistics and domain expertise (judgment) can be applied to significantly enhance the structured-judgment procedure.

There's anecdotal evidence that these enhancements have the potential to improve forecast accuracy and reduce — from days to hours — the time needed to create a new-product forecast.

There's anecdotal evidence that these enhancements have the potential to improve forecast accuracy and reduce — from days to hours — the time needed to create a new-product forecast.

There is now an automated structured-judgment procedure using machine-learning algorithms (e.g., neural networks, gradient boosting, and ensemble random forest models) to forecast new-product launches. These additional enhancements to the process have resulted in boosting accuracy as well as further reducing time to create new product forecasts. Some companies are reporting reductions from hours to minutes to create a NPF.

Using unstructured data to complement structured approaches

Another augmentation to structured judgment can be achieved by integrating structured and unstructured data using sentiment analysis. Sentiment analysis incorporates text mining techniques that collect unstructured data from social media, the Internet, and other sources to examine what people are saying about the new product in real time.

For example, once a large enough sample is collected, analysis of unstructured data would determine if consumers like the new product, liked the supporting promotion, can find the product on-shelf, and favor the product’s quality.

What is sentiment analysis?

Sentiment analysis automatically extracts sentiments in real time or over a period of time with a unique combination of statistical modeling and rule-based natural language processing techniques. Built-in reports show patterns and detailed reactions. Sentiment analysis uses a combination of statistical and linguistic rules to identify positive, negative, neutral, or unclassified opinions from unstructured text data. Multi-level taxonomies can now be defined, so that sentiment can be derived for the overall document, a concept in the document (such as a brand or product), an attribute or feature of the product, and characteristics of features with different linguistic rules defined for each level.

Sentiment analysis can be employed to capture what consumers might be saying about new product iterations — for example, perhaps customers would like a different flavor, a new color, a different package size, etc. All of this information allows companies to adjust the launch forecast sooner in the cycle, within the first 13 weeks of the launch, to assure successful marketing planning, merchandising, and product management.

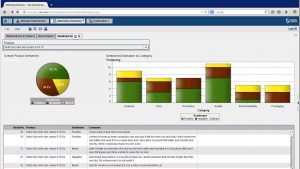

Here is an example (Figure 1) of a dashboard using sentiment analysis to capture real-time information during a new product launch.

After four weeks of crawling out on social media and the internet (i.e., Facebook, Twitter, and others) using text mining, enough information is captured to run sentiment analysis and surface the results in a dashboard.

In this case, the results indicate 47.7 percent of consumers who purchased the product liked it; 34.1 percent of consumers didn’t like the product and the remainder had mixed views of the new product. A large percentage of consumers liked the feature in the store circle; consumers were mixed regarding the price; and many liked the sales promotion; and almost all liked the product quality. However, the product was difficult to find on store shelves, and no one liked the packaging.

What actions can be taken?

This information is critical to the success of the new product launch, and product sustainability. For example, an alert would be sent to the sales team telling them that close to 50 percent of consumers like the new product, but can’t find it on shelf. Another message would be sent to marketing alerting them that the store circular and sales promotion were successful, but the packaging is not well accepted. If the new product launch starts to slow after week six, marketing can run another promotion supported by a store circular to encourage more consumers to purchase the new product.

Finally, using text mining we can see what people are saying about the product. For example, “I wish the product came in a different package size,” or “I wish the product came in different flavors,” or “I wish the product came in different colors.” Now we have information that can be used for sustainability purposes. The marketing department can launch different package sizes, flavors and colors six months to a year after this new product launch as the product matures to extend the product offerings.

How has SAS improved NPF capabilities?

SAS recently added machine learning to its new product forecasting offerings. Several large consumer packaged goods and apparel companies are now using SAS to forecast new product launches with remarkable success. Not only has SAS automated the NPF process, they have significantly reduced the time to create NPFs from weeks to hours. Customers are seeing (on average) a 12-15 percent improvement in NPF accuracy, and in some cases as much as 28 percent improvement in their one to three month launch windows.

The real benefits are the large-scale capabilities allowing them to forecast hundreds of thousands of NPF SKU combinations each year. These forecasts are produced weekly in less than two hours and run alongside their normal weekly forecast process in batch mode.

Want to know more? Download this new product forecasting white paper.