Regulations, corporate drivers, leadership and market influences have combined to produce a patchwork of uneven progress on initiatives such as distributed generation, customer choice, asset optimization and the industrial Internet of Things. These initiatives all rely on analytics to gain the most return on investment.

Regulations, corporate drivers, leadership and market influences have combined to produce a patchwork of uneven progress on initiatives such as distributed generation, customer choice, asset optimization and the industrial Internet of Things. These initiatives all rely on analytics to gain the most return on investment.

To better understand organizational readiness for analytics and key areas of analytic priority in this diverse business landscape, SAS conducted an industry survey. The survey tallied responses from 136 utilities from 24 countries. More than half of the responses were from the US, with Australia, Canada, New Zealand and Denmark rounding out the top five. The survey explored the issues and trends that are shaping how utilities are deploying data and analytics to achieve their business goals. Our findings include:

- Utility business units have primary ownership for the selection and funding of specific applications and business strategy. This is readily apparent as utilities take an enterprise approach to how they're moving forward with analytics. IT participates to ensure that the proper infrastructure is in place to take full advantage of the analytics capabilities available today.

- IT departments are still critical to a utility’s success in its analytics journey. This is especially true in the early stages, when the information architecture and data management set the table for future analytics successes. However, as utilities become more sophisticated in how they use their data, the business units are more in control in terms of aligning data and analytics with business strategy and creating value from all data.

- The most popular analytics applications and solutions are focused on improving customer relationships and engagement, along with those improving energy forecasting.

- Open source technologies are affecting how utilities deploy analytics. While not best suited for scalable, enterprise-wide analytics endeavors, open source tools are becoming an important part of the mix as utilities move from basic data functions and reporting towards a more predictive and prescriptive environment.

Before diving deeper into some of the survey findings, a brief pause to consider the sweeping changes that the utility industry is currently experiencing is merited. These changes are, in many cases, driving the need for analytics. Those changes include:

- Declining load growth, which means flat-to-shrinking revenues and a need for more efficiency.

- Business model transformation as the traditional utility-to-customer relationship is being disrupted by renewables.

- An increase in cyber-security threats, which is a factor any time a new system or data source is under consideration.

- Aging assets, creating both opportunities (for next generation technology implementation), as well as challenges (how to pay for it).

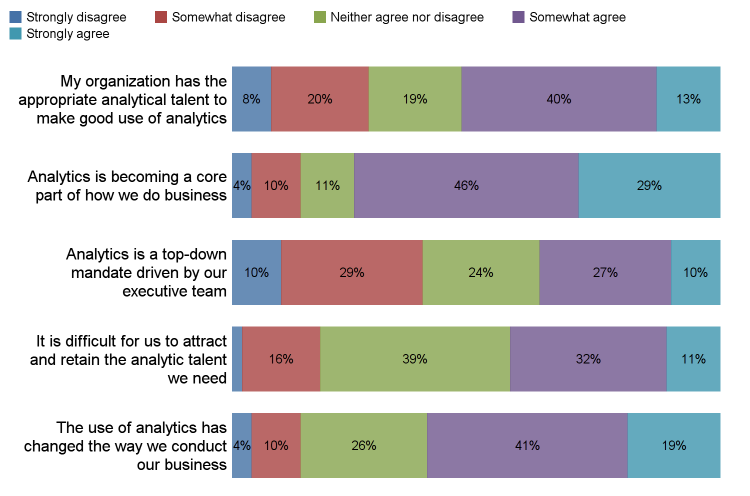

Given this changing landscape, how do utility leaders see analytics playing a role in meeting their business challenges? Figure 1 below provides a look at the challenges and opportunities for utility analytics.

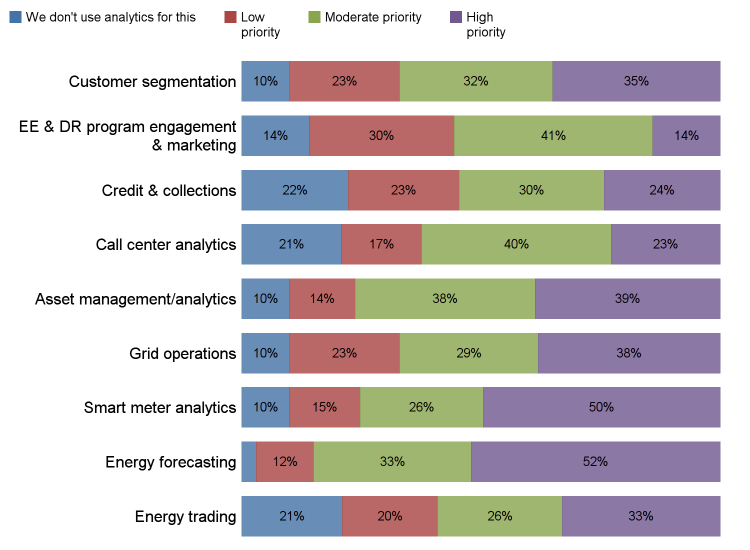

And what business areas do utility leaders see as being the best opportunities for analytics to improve their operations? Figure 2 below provides a summary of the priorities for using analytics in a utility's different business areas.

So, given these survey results, where does this leave the utility industry vis-a-vis analytics?

While there's no single, simple answer, leveraging data as a strategic asset will be key to utilities surviving and possibly thriving in the future. Having invested billions in an intelligent infrastructure over the last 10 years, utility leaders are now seeing that the real value and ROI opportunities lie squarely with the data.

Read the full results of the survey in this white paper: Utility analytics in 2017. Learn more about SAS Utilities solutions.