You’ve likely played an organized sport at some time in your life - How many different ways were there to keep score? How many different ways were there to determine the winner? Just one – right? It was goals, or runs, or points, or something, but never goals and/or assists, or some weird combination of runs, hits, errors, average, ERA, RBI’s and on-base percentage.

You’ve likely played an organized sport at some time in your life - How many different ways were there to keep score? How many different ways were there to determine the winner? Just one – right? It was goals, or runs, or points, or something, but never goals and/or assists, or some weird combination of runs, hits, errors, average, ERA, RBI’s and on-base percentage.

Now, ask the same question about your business – how many ways do you have of keeping score, of determining if you’ve “won” (i.e. met your key strategic objective)? Do you have just one metric that answers this key question, and does everyone understand that – is everyone on that same page? Or do you have a dashboard with dozens of different metrics that all sort of dance around the issue without explicitly hitting the mark?

This was the lesson I learned from a terrific presentation by Doug McCallen, CFO for Caterpillar’s Building Construction Products division, where their single strategic metric of choice for keeping score is OPACC (Operating Profit after Capital Charge), which I will explain in more detail below.

There are a number of approaches one could take in conformance with the spirit of this argument, the most obvious being to build your enterprise dashboard around this single, key metric – the speedometer in the middle so to speak. The particular metric / methodology chosen needs to suit your corporate culture. As I mentioned in a previous post, I'm partial to ROA or ROCE (return on capital employed), although good cases could also be made for ROE or simply some measure of profitability such as EBITDA.

Caterpillar’s McCallen calculates OPACC as operating profit over and above an applied capital charge equal to 17% of net assets (pre-tax). This metric has several benefits, notably that it relies solely on readily available internal data, and that the inclusion of an asset charge takes the focus away from just variable margin (i.e. sales making the claim that any sale $1 above variable cost is a good sale). One clear effect of highlighting the asset charge is that it changes how the company looks at production location, logistics, markets and offshoring decisions. Having to account for inventory tied up in transit and in long distribution channels tends to force the economic decision of keeping production close to the customer, which leads to other customer satisfaction benefits as well.

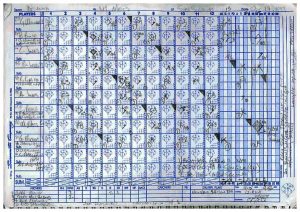

The way to think about the metrics on the rest of the dashboard is to continue with my baseball sports analogy and treat the other metrics as supporting, actionable, operational ‘statistics’ that correlate with the primary strategic metric. Just as baseball reverently keeps its stats on hits, RBI’s, errors, ERA, etc …, it’s only Runs Scored that matter in the end, and as ‘Moneyball’ taught us, lesser known / used stats such as On-Base Percentage are more highly correlated with runs scored than RBI’s or batting average. When they are positively correlated, and you’ve chosen the best measure (versus measuring the same thing three different ways), they can serve as actionable, intermediate warning signals that all will not be well for the primary metric at the end of the period (also, see my earlier posts, “Metrics for the Subconscious Organization” and “Metrics for Critical Behaviors” for more thoughts on this matter).

This “single metric” approach, however, would seem to fly in the face of the popular Balanced Scorecard methodology, it being decidedly ‘unbalanced’. You could almost say that we’ve been so indoctrinated in the balanced approach that anything else seems sacrilegious. After all, doesn’t the scorecard part of the “balanced scorecard” already account for how you decide if you’ve won or not, with the dashboard playing the role of the dutiful baseball statistician? However, if you find your organization engaged in a lot of measurable activity but still not scoring the necessary runs to win the game, you might want to seriously consider this more focused business intelligence technique as part of a larger cultural chance management initiative. Or more to the point, if you find yourself still paying out large performance bonuses for frankly less than stellar overall enterprise performance, aligning behind a single score-keeping metric might be just the solution you’ve been searching for.

6 Comments

Read Cee Angi's wonderful article about keeping score in baseball: http://baseball-prose.com/2012/09/07/the-subjective-art-of-keeping-score/

I don't think the 'single metric' approach is in conflict with the Balanced Scorecard Leo, as long as we think of it as the ultimate Financial result in a Strategy Map. As you say, the objectives in the other perspectives are the levers the organisation is pulling on to execute a cause and effect hypothesis towards that result. I suspect that a lack of evidence for correlation and causality means that measures have low information value, its like hoping the number of spectators at the game will produce more runs, goals or points ...

Pingback: Innovating for the Numerator - Value Alley

Pingback: Innovating For the Numerator | EPM Channel

Pingback: Analytics for your varied team member styles - Value Alley

Pingback: Objectives that drive strategy - A lesson in strategic planning from NASA and the Kennedy Space Center - Value Alley