Today, we live in a polarized world that divides family members, friends, and business colleagues. It effects everything we do from the way we communicate with one another to how we handle business challenges. I have seen long time business colleagues have passionate discussions to defend their supply chain position regarding what adds more value. As a result, we now work in what I refer to as the “polarized supply chain”, where you are either a believer in supply or demand. Sound familiar? We get caught up in what we are comfortable, or what we believe is the “holy grail” to fixing the inefficiencies in the supply chain. The pendulum seems to swing back and forth from decade to decade focusing on supply or demand “processes and technologies” with little emphasis on people (skills and changing behaviors), and virtually no attention to predictive analytics.

Today, we live in a polarized world that divides family members, friends, and business colleagues. It effects everything we do from the way we communicate with one another to how we handle business challenges. I have seen long time business colleagues have passionate discussions to defend their supply chain position regarding what adds more value. As a result, we now work in what I refer to as the “polarized supply chain”, where you are either a believer in supply or demand. Sound familiar? We get caught up in what we are comfortable, or what we believe is the “holy grail” to fixing the inefficiencies in the supply chain. The pendulum seems to swing back and forth from decade to decade focusing on supply or demand “processes and technologies” with little emphasis on people (skills and changing behaviors), and virtually no attention to predictive analytics.

“We are at a pivotal point in the three decade old supply chain journey. Are we going to continue to address the symptoms, or finally take action to fix the root cause of our supply chain challenges?”

Can you handle the truth? Everyone seems to be high on supply these days as they continue to smoke inventory crack. They justify their addiction on the fact that forecasts will always be wrong. Well I have news for our supply-driven friends. Why is it that when we under forecast companies experience large volumes of backorders, and when we over forecast companies sit on huge volumes of finished goods inventories? What’s more, why are our supply centric colleagues suddenly abandoning their solution of using buffer inventory (safety stock) to adjust for demand volatility? By the way, I agree completely that a 1-3% increase in forecast accuracy will have very little impact if any on safety stock or finished goods inventories, particularly, if your forecast accuracy is already above 85% on average across the entire product hierarchy. At that point, each additional 1% of accuracy (or reduction in error) requires exponential investment in time and labor with minimal effect on buffer inventories. Of course, that is if your forecast accuracy at the lower mix levels (i.e., product/SKU or SKU/demand point) are above 70%. We have found that over 90% of companies today still focus on measuring forecast accuracy at the highest aggregate level of the product hierarchy with little if any attention to the lower mix accuracy. In fact, the average forecast accuracy across all industries is between 50-65% on average at the aggregate level, and between 35-45% at the lower mix levels. How do we know? These numbers have been validated not through surveys, but working directly with over 100 companies during the past 10 years. So, there is a lot of room for improvement regarding demand forecasting accuracy. Much more than 1-3%.

The root cause not the symptom. A classic case of poor demand forecasting is when a company ships in more products than the retailer sells, while simultaneously incurring backorders. So, you would think how could that happen? Well it’s all about the product mix. Not only did the manufacturer ship in more product than the retailer sold they shipped in the wrong mix of products. So, now the retailer is sitting on excess inventory that is not selling. So, what does the manufacturer do? They discount the products in inventory at the Retailer by running sales promotions and other related incentives in an attempt to reduce the inventory. This has a negative impact on profit margins and market share.

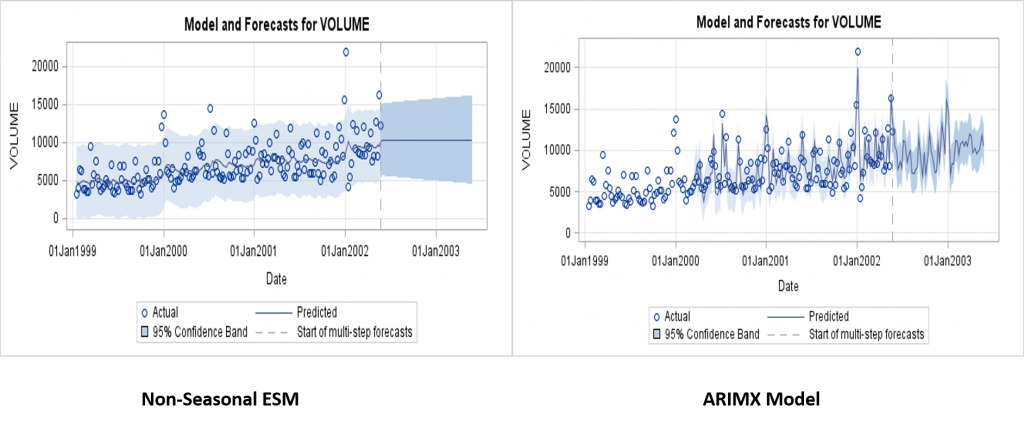

In addition, the forecasting methods being deployed mainly moving averaging and non-seasonal exponential smoothing models are only accurate one period into the future. As a result, the upper/lower forecast ranges (confidence limits) that are a key input to safety stock calculations tend to be cone shaped (exponentially get larger as you forecast out beyond one period). This is why the impact in many cases increases safety stock volumes, rather than lowering them. This is not the case when using more advanced statistical methods like ARIMA, ARIMAX, and dynamic regression (predictive analytics) as they are more accurate further into the future, so the upper/lower forecast ranges tend to be tighter (more consistent to the forecast, not cone shaped) as you go further out into the future. These models actually help lower safety stocks not only through more accurate forecasts, but by reducing the upper/lower ranges of the forecast. Which demand forecast in Figure 1 would you choose to drive your safety stock calculations?

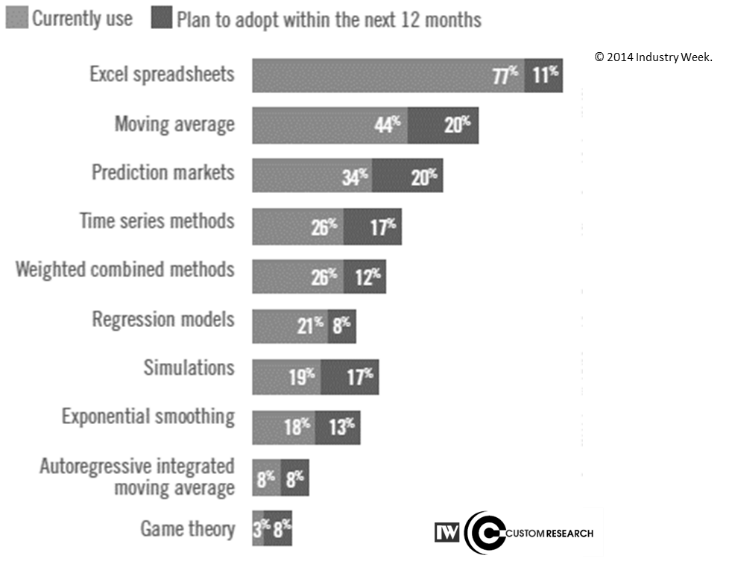

The 3rd party validation: In a 2014 IndustryWeek Report they found that 77% of demand planners use Excel and the number one statistical method being deployed is moving averaging. When we asked why is that? We found it was the result of their ERP solutions restricted model selection, which only supports simple statistical forecasting methods (mainly Exponential Smoothing). It is also interesting that IBF surveys published a decade ago found that 40%-44% of demand planners used Excel and the number one mathematical method at the time was Winters three parameter exponential smoothing. It turns out that ERP/Demand Planning technology deployed during the late 1990's at most companies only supports simple statistical methods (moving averaging and ESM). In fact, the one area of the supply chain that has received the least attention and investment in people, analytics and technology over the past decade is demand forecasting and planning.

The proof is in the analytics. Using proof-of-values (POV’s) conducted with multiple companies over the last 6 years we have shown improvements in forecast accuracy of anywhere between 10%-30% (and in some cases up to 50%) on average up/down company’s product hierarchies by just deploying “holistic” modeling driven by predicative analytics not sales targets, financial plans, and/or judgmental overrides. In fact, we have proven using historical demand data (uncleansed) combined with predicative analytics that there is no reason to cleanse demand history (shipments/sales orders). In fact, cleansing demand history is actually a bad practice. Cleansing historical demand to separate it into baseline and promoted volume actually makes the forecast less accurate. In 95% of the POV’s conducted we saw improvements in demand forecast accuracy in the range of 10%-25% significantly lowering buffer inventories (safety stock) and finished goods inventory. Furthermore, we found that applying multi-echelon inventory optimization, auto leveling, and other advanced analytics for supply planning along with improved forecast accuracy creates a synergy effect of another 15-30% reduction in finished goods inventories, thus reducing costs and freeing up working capital.

Another reason why improved forecast accuracy doesn’t have a strong impact on inventory safety stock is because no one is actually forecasting demand, but rather supply. Those companies who are moving toward becoming demand-driven and ultimately market-driven are engaging sales and marketing and linking downstream data to upstream data using a process called, “Multi-Tier Causal Analysis” (MTCA), or what can be referred to as "Consumption Based Modeling". Many have seen as much as a 25 bases point (or 50%) improvement in forecast accuracy for shipments on average across their product portfolios. They have also statistically proven that there is a direct correlation between downstream data and upstream data (Chase, JBF 2015 Spring Issue, Volume 34, Issue 1). So, why do we continue to say that improved demand forecast accuracy has no direct impact on supply?

We need to stop relying solely on either demand or supply as a quick fix to our supply chain challenges. Companies need to take a holistic approach to solving the root cause, which focuses on people (skills), process, predictive analysts and technology that is driven by structured and unstructured data addressing both supply and demand. I call it the “holistic supply chain”. We also need to change the basic definition of supply chain management (SCM) to include the commercial side of the business. If companies continue to polarize the supply chain and rely solely on supply or demand centric solutions they will never realize the full benefits.

Conclusion: Successfully implementing an agile supply chain will require a holistic view of supply and demand. If anything, the one thing we have learned over the past three decades —“relying only on supply responsiveness is a recipe for failure”. So, are you supply centric, demand centric, or holistic when it comes to supply chain management. I was demand centric, but have since gone out of my comfort zone and view the supply chain holistically.

4 Comments

Dear Charlie,

First thank you for demystifying the most controversial topic in Supply Chain management.

Let me build on your ABC (assume nothing, believe nothing, challenge everything) answer.

I am an Engineer who did not understand what statistics had to do in my Master of Technology when I simply wanted to solve the world.

For 26 years in 2 outstanding FMCG companies, elevating the share of voice of Supply very high, I have been fighting with the Demand side of the business....the "dark side" as we were calling it.

I have been challenging back an army of planners who were asking me to fire my operators to reduce stocks and asking me 2 months after to hire them back with no notice as service was down by 10%.

I have been fighting with my Chief Officers telling them rather than challenge the GM we could collaborate to make him winning, not us winning.....

I have come to the following principles for collaborating:

1. Supply Chain management is about stabilizing, collaborating and orchestrating

First you stop the noise, you do not show your muscles or neurons when engaging with Marketing or Sales. They are super well equipped to and generally speaking communicate better than us. So you park your EGO before going into a S&OP meeting by putting the supply house in order, by being transparent , reliable and resilient.

This is called the credibility line, you build trust.

2. Supply Chain is having 4 point of Truth:

- the point of sourcing

- the point of execution

- the point of sales

- the point of use/consumption

When you want to track progress , you only measure at one of those 4 points.

The role of the leadership is to give or hold the "license to operate", this is called the capability journey

3. Cash is King, Service is its Queen:

First the Brand is a story, the product its Hero.

So yes you engage on Quality in S&OP meetings, yes you talk about mental and physical availability the 2 easiest source of growth: one for Marketing, one for Supply and Sales.

So you collaborate, as you can not dissociate both, this is the interdependency making it a high performing team agenda.

To win, you need others to support you and like versa.

4. In Planning , a naïve model is the cheapest solution, solving 80% of the magic triangle "service-costs-cash".

This is junior planning capability.

When your business is seasonal, or under "activity management", move from "dead" to "live" data, the current digital revolution is allowing you to do so, you will stop the endless frustrating conversation in S&OP.

This is a senior planning capability leveraging on Analytics.

In S&OP shift the mind set from "Supply is managing, we are the only one to be disciplined in our business" to "we are all here to make the GM winning every month, he is the striker, we are the team on the field".

5. We have entered into the 4th revolution on Earth, the digital one:

The first one was the invention of the wheel, as the knowledge can travel from point A to point B.

The second was the writing, as everybody who reads has the power to know.

The third one is the printing, as the knowledge is available to anyone, if you buy or get the book.

The fourth one is the internet, when the knowledge is instantly available to anyone connected.

So you do not need the senior planner being paid for his judgmental decision making a difference every five years....

You do not need to invest into €500Mio of SAP x APO when your planers do not even remember or know what is statistics about (only 4 formulas to know by the way).

You do not need to know everything, like the VP I am.

You just need to collaborate with the best academics, the best Supply Chain peer competitors and create a brighter community facing the one who are inventing unicorn Brands, our best friends at work....as they fill our factories, the Demand side !

So sorry for a too long post, we just enter into a new era:"From the internet of things to the cloud of possibilities".

the ones who will win are the ones who are embracing the opportunity, who are getting comfortable being uncomfortable, not solving the Sales forecast accuracy.

Do not loose their time, they are just learning to dance under the warm rain of the storm and have fun everyday, as they know the sun is coming soon ))

A bientot,

Hi Xavier,

Thank you for your comments regarding this Blog posting. Your feedback and comments are greatly appreciated. I particularly like your quote, "We just enter into a new era, from the internet of things to the cloud of possibilities".

Charlie

Great point Charlie about the continual need for innovation on the demand and supply sides of the service optimization challenge. If anything, we all agree that service expectations will only increase in the future, so why not attack both sides of such a complex issue.

Your point about the need to measure planning accuracy at the lower mix level is spot as well. There is normally a big potential for improvement at this level in most industry segments. And, its needed to driving capability based inventory plans as well

I agree with you all that we are entering new grounds since the MRPII of Oli Wight (1970s though) but if I understand anything about Demand-based Planning is that we have to take into account the selling resources we are going to invest when planning. Otherwise we go back to assume ceteris paribus (everything stays the same) and we just go and use some statistical forecast and assume that driving looking the rear view mirror is the way to go. I am still waiting for us (in the business) at least to be serious and start viewing the close-loop as the fulfillment of planning by selling what we planned and start measuring against the plan instead of against the cornucopia.

I like the efforts though.