With all the enhancements in demand management over the past decade, companies are still faced with challenges impeding the advancement of demand-driven planning. Many organizations are struggling with how to analyze and make practical use of the mass of data being collected and stored. Others are perplexed as how to synchronize and share external information along with internal data across their technology architectures. Nevertheless, they are all looking for enterprise-wide solutions that provide actionable insights to make better decisions.

Bad practices

Bad practices

Before we can address all the demand planning challenges regarding people, process, analytics and technology, we need to address the many bad practices that must be overcome before companies can truly embrace the benefits of demand-driven planning. The reality is that these bad practices translate into mistakes and perceptions that hinder the progress of demand management. Those mistakes are still being made today after two decades of data collection, storage, processing, analytics, and technology improvements. In many cases, the conceptual design is sound, but implementation is flawed due to corporate culture and related political bias.

In fact, it doesn’t matter the size of the company. I have sat across the table from several supply chain management teams over the past 11 years at companies that span from less than $1 billion to over $100 billion in annual sales. Talk about evoking emotions with the words "demand forecasting", or "demand-driven planning", not to mention "market-driven". And while the atmosphere in those rooms might be described as fill with despair, disillusionment and skepticism, it is far from hopeless. For me it was like Déjà vu from those early years in my career working at a large CPG company--no analytics, no technology other than spreadsheets, and 100% “gut feeling” judgment injected into the process by multiple departments including sales, marketing, finance, and operations planning. All in an attempt to create a "one-number" consensus forecast (technically a 'supply plan'). There was no real attention paid to accountability and little if any attention to the product mix, as the focus was always on a top-down forecasting (planning) process. These supply chain leaders didn't just want to improve their demand management process, they had no choice due to the fact they were sitting on anywhere from $100M to over $600M in excess finished goods, WIP, and raw material inventory. Typically with over $75M to $400M was in finished goods alone. Talk about being supply centric in their approach to demand management. I guess using buffer inventory to protect against demand volatility doesn’t work after all.

Demand forecasting and planning is still the biggest gap

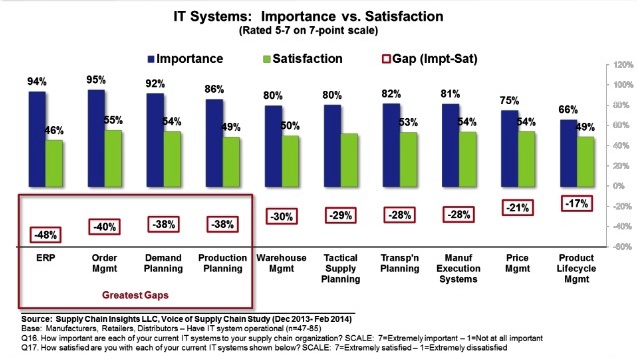

After two decades of attention and focus, the demand forecasting and planning process still has the largest gap between satisfaction and performance based on a survey conducted by Supply Chain Insights (see Figure 1.). To say that excellence in demand management still eludes most supply chain teams would be an understatement. Subsequently, demand forecasting and planning is obviously still a key focus area for most companies over the next two years. For most, it is the biggest challenge that they will face in the supply chain journey. Companies want to improve demand forecasting and planning, but have focused mainly on the process with little or no attention to improving data quality, people, analytics, and technology. As a result, their skepticism dominates their approach, with many having already conceded that they can never be successful in improving demand forecasting. As indicated in those surveys, demand forecasting and planning is important to supply chain leaders, but is also an area with the largest gap in user satisfaction.

Based on my personal experiences visiting companies, I have found that demand forecasting and planning is the most misunderstood supply chain planning process with little knowledge of how to apply analytics to downstream data (POS/Syndicated Scanner data). Also, well intentioned consultants have given bad advice, particularly, that a "one-number" forecast process is the key to success. In my experience, the one-number forecast does not work. It only encourages well-intentioned personal bias, and is used to set sales targets, financial plans, and other factors that are not directly related to an accurate demand response. What drives excellence in demand forecasting and planning is the ability to incorporate sophisticated data-driven analytics into the process using large scale enabling technology solutions to create a more accurate unconstrained demand response. Once that unconstrained demand response is adjusted for sales, marketing, finance, and/or operational constraints it becomes a sales plan, marketing plan, financial plan, and/or a supply plan.

The need to admit bad corporate habits

Companies are quickly learning that in order to move forward, they need to admit their bad practices of the past. They must be willing to take risks in order to move forward. Leaders must confront a number of mistakes made in the design of their demand management processes over the course of the last decade. The mistakes are many, but all can be corrected with changes to the process, the use of downstream data, the inclusion of analytics, and most all, introducing and training demand analysts as how to apply predicitive analytics. The past is full of good intentions and poor execution that have caused companies to make key mistakes in demand management over the years.

So, does this all sound familiar, or are you still in denial?