Once upon a time: The toy industry has invited me to the world‘s largest toy fair, which took place recently in the city of Nuremberg. With close to 3,000 exhibitors the toy fair is bigger than ever before.

Success is the theme of the event, and most German retailers cannot complain with consecutive growth numbers since 2008 (2013 is the only exception). A good portion of this growth has been driven by the rise of Lego throughout the last couple of years. The Danish brick builders have just claimed the market by becoming the world`s leading toymaker in front of companies like Mattel and Hasbro. Just by the way: This development could be of the reasons why Mattel is now trying it`s luck with a new CEO.

Let`s look a bit deeper into the mechanics of the toy core season business and why the toy fair is a very important time of the year, even though the most important time for the toymakers’ business, the Christmas season, is just over.

From wish list to supply chain management

As the holiday season approaches, many children anxiously look forward to new toys under their Christmas trees, and prepare their wish lists weeks in advance. However, each year, toymakers must make decisions on how many toys have to be built many months in advance. So it is all about balancing the children`s demand with the supply that has to be built.

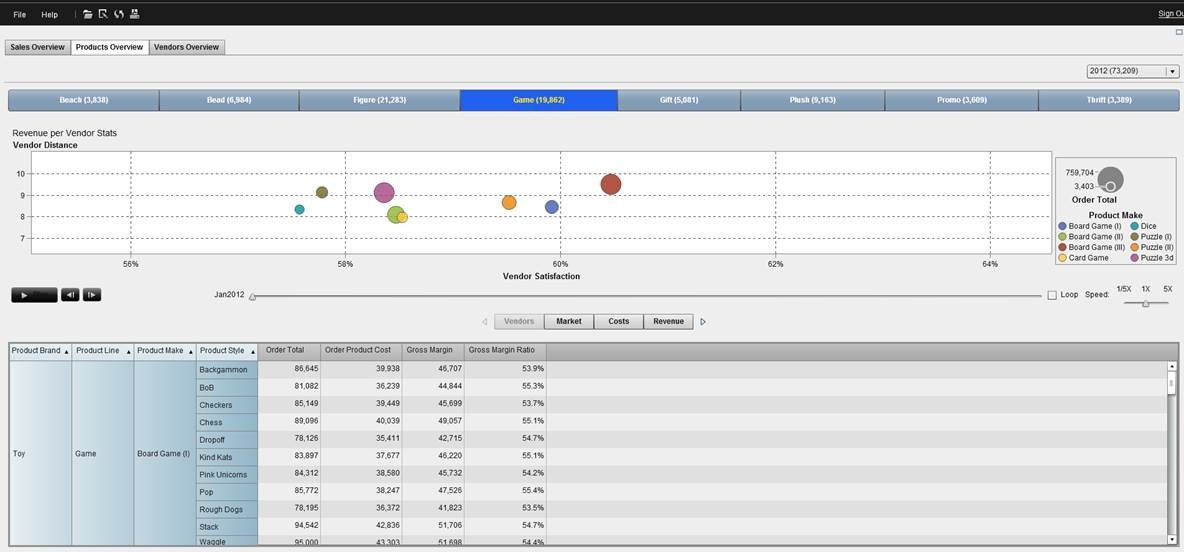

The biggest challenge is to define well in advance which toys will be the season`s top sellers and trends, and determine how much merchandise will be sold through multiple channels. So toy manufacturers must ramp up production by mid-year to ensure that they will be able to meet consumers demand and have the right product at the right retailer shelf at the right time for sale.

One of the main challenges the industry faces is that childrens’ wish lists are not written before late in the holiday season and parents will not be able to share any reliable information about what they plan to buy for all the little Toms and Lindas before then. To bridge this gap, toy companies use market research as well as market data in order to predict the outcome of a highly volatile holiday season in terms of demand. However, the very late buying decisions of consumers make it really hard to predict the right numbers.

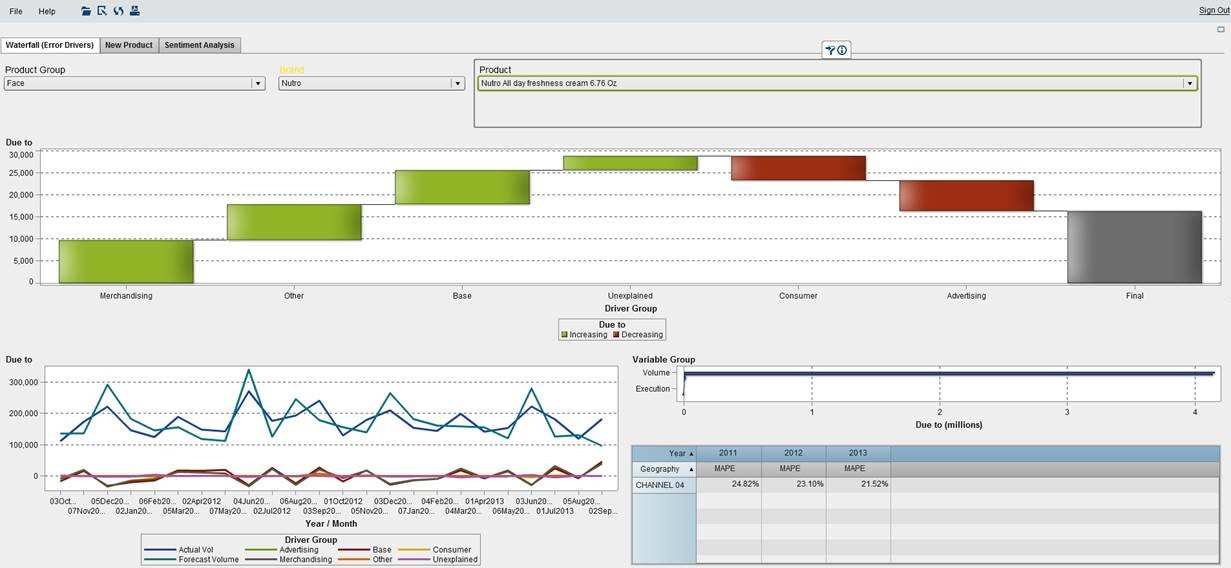

To better predict sell through in high season, some rare analytical approaches can bring massive benefits by increasing the accuracy of sales forecasts at Christmas time.

One idea is to incorporate all the demand data like price, promotion, secondary placements, television campaigns, retail flyers etc. into one demand signal pool. This data can be used to predict the sell through of portfolio and new product toys by leveraging the strength of advanced analytical models that incorporate causal factors into forecasts. By sensing market signals, translating them into demand signals, and using those demand signals to shape future demand, toy sales can be better predicted and even be influenced.

Of course, making this approach work starts with data and information availability. In a perfect scenario, retailers would commit to placing their orders and offer information on catalogue items right after toy fair.

So far only one of the main toy manufacturers has reached that level of early commitment on orders from their retailers. You guessed it: The Danish brick company!

In the future, however, this market-driven approach will become an integral part of the demand management process for all manufacturers in the toy industry. So companies should make sure they are ready for a more market driven approach when it comes down to predicting high season sales.

For more detailed information seasonal planning for retailers, be sure to check out this demand forecasting Whitepaper.