Is Iran right that oil is heading for $25? Are OPEC and the International Energy Agency (IEA) right that prices will rebound later this year? The headlines suggest that, whatever the case, oil isn’t ready to recover the enormous value it has lost in recent months. With upwards of a million barrel-per-day global oversupply, traders are closely monitoring US rig count. Total SA this week joined other majors in cutting American shale oil production spending, but analysts warn that it will take time for production cuts to sop up the glut. The outlook has not been helped by the IMF’s dour global demand forecast this week.

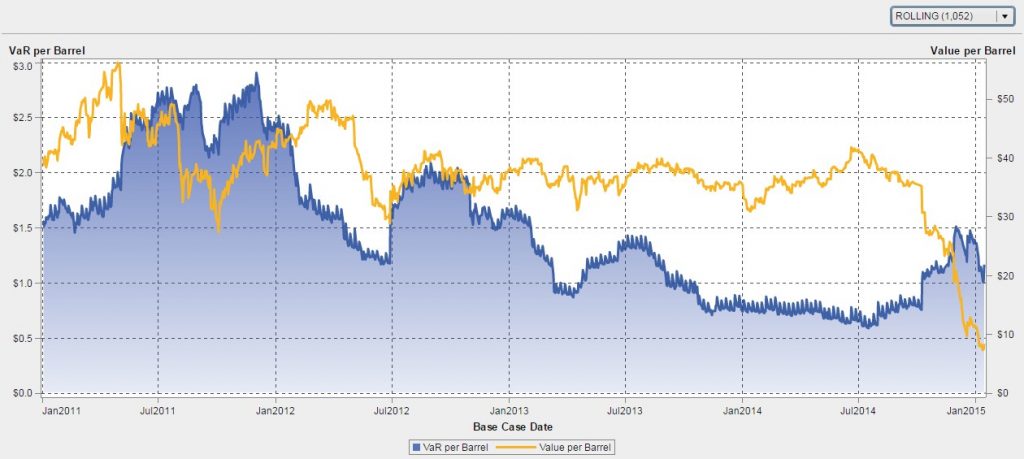

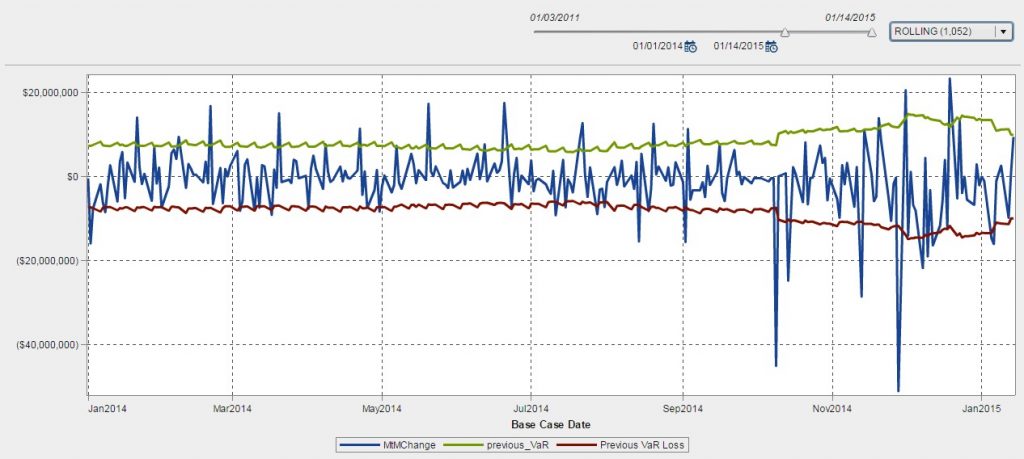

What does that mean for VirtualOil’s fictitious energy production portfolio? Our charts capture how dramatically price declines spiked volatility late last year, but also that a correction today has less impact at the much lower base values. With oil prices simmering below $50, the actual price volatility delivered by the market has stabilized. Our Value-at-Risk backtesting vividly illustrates that the price came off hard but things are leveling out. Mark-to-Market has stabilized due to both the spot price movement and the value in our portfolio.

Chart: VirtualOil VaR Backtesting

VirtualOil’s options are now more valuable as implied volatility in the market for forward prices increases. Looking a year out, we see a fairly steady contango structure in WTI prices: the market is anticipating a rebound, so the one-year-out contract is up about $7 against the spot price per barrel. Our benchmark is recording what the market delivers: The valuation of the VirtualOil structure captures the forward valuation, the contango and the higher implied volatility.

Chart: VirtualOil Five-Year Rolling Portfolio

What’s changed since last month is that spot prices have dipped below our $50 strike price. That means VirtualOil has in effect temporarily shut in its well. There’s no cost impact to shutting in because the portfolio is purely financial, but the spot price does mean that as our current month options expire, they are out of the money. If the WTI monthly price for Feb. comes in below $50, we may shut in again. But next month and beyond, that may not be the case. We still have value in our production in the forward market.

The takeaway? Don’t get too discouraged despite the headlines.

See below for additional visualizations of varying vintages. Join us back here each month to see how VirtualOil is performing and how the risk analysis is evolving.

Assumptions

The hypothetical derivatives-based oil production firm VirtualOil simulates the performance of a generic crude oil asset, and delivers sectorial exposure to the commodity oil market. Specifically, the VirtualOil structure starts up with an investment of $350 million in monthly average price call options with a strike price of $50/barrel on the price of West Texas Intermediate (WTI) light sweet crude oil. The strip of options starts at 10,000 Bpd and extends out for 5 years with a 20 percent average annual decline in underlying notional barrels, replicating a physical oil asset. VirtualOil initially holds notional crude oil reserves of approx. 10 million barrels. Monthly cash flow is generated when the daily average WTI price relative to the preceding month exceeds $50/barrel. Cash flow is reinvested monthly at 5 percent and the project winds up when the reserves are depleted.

VirtualOil is managed in SAS® BookRunner with reports surfaced in SAS® Visual Analytics. Learn more about SAS BookRunner’s state-of-the-art energy trading & risk management capabilities.

Chart: VirtualOil Jan 2011 Start Date Portfolio

Chart: VirtualOil Jan 2012 Start Date Portfolio

Chart: VirtualOil Jan 2013 Start Date Portfolio

Chart: VirtualOil Jan 2014 Start Date Portfolio

Disclaimer: This is a fictitious portfolio and is not a solicitation to trade.