One of the most widely attended sessions at the BAI Retail Delivery conference was a Q&A hosted by John Colas, Partner at Oliver Wyman. Colas was interviewing David Silberman, the Assistant Director, Deposit and Payment Markets Consumer Financial at the Consumer Financial Protection Bureau (CFPB). As you can imagine, there was a great deal of interest among the financial services audience about what Silberman could tell them of the roles, ambitions and priorities of this new regulatory branch. For background:

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) established the consumer bureau. On September 17, 2010, President Obama and Treasury Secretary Geithner named Elizabeth Warren as Assistant to the President and Special Advisor to the Secretary of the Treasury on the CFPB.

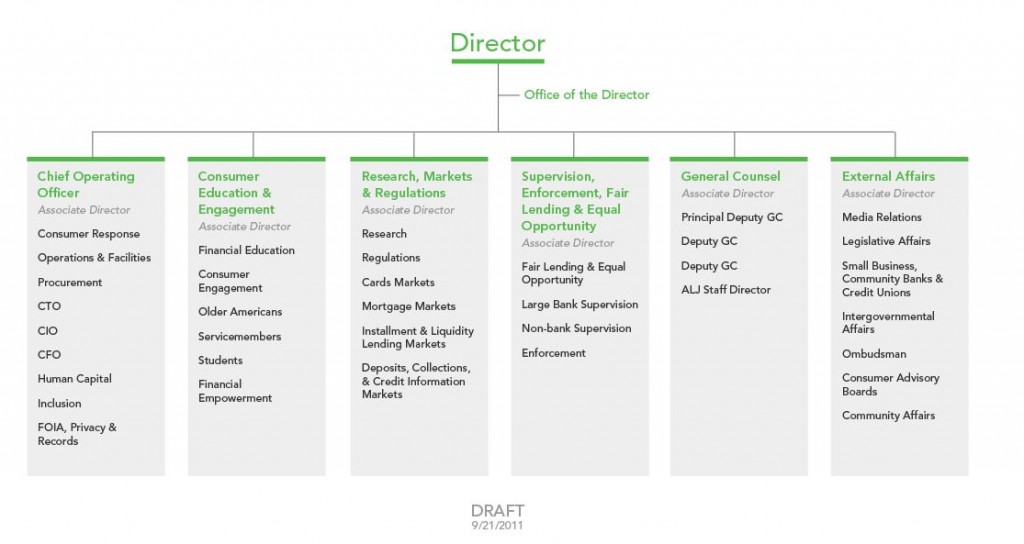

Raj Date is currently leading the Bureau’s day-to-day operations in his capacity as the Special Advisor to the Secretary of the Treasury for the Consumer Financial Protection Bureau. On July 18, 2011, President Obama nominated Richard Cordray, the head of the Bureau’s Enforcement Division, to be the first Director of the CFPB. This nomination is currently pending before the Senate. ~ Fnd online: CFPB, Getting started.

The bureau has only been active for about 3 months, so Silberman said that the near-term goals will be to focus on recruiting the best people and finding the best tools that are available. “A lot of our effort right now is focused on building a great and effective organization,” he said.

Silberman said that the statute tells the CFPB that there are three markets to initially focus its energies on:

- Mortgage brokering and servicing

- Payday lending

- Private student lending

Coles ran the Q&A portion of the presentation like an interview – albeit an interview in front of more than 300 financial services executives who were not that excited about yet another regulatory agency.

Other areas of CFPB interest

“What are some of the other issues that the CFPB will be looking at?” Silberman shared three other areas of focus where the CFPB would be concerning itself: student loans, consumer deposit protection and credit card protection. “Student lending is an area where defaults continue to increase. Right now there are some concerns about how that market is working … Does the system have the capacity to service these loans given their performance? Is this going to be the next wave like the one that we’ve seen in the mortgage servicing area? We’ll also want to look at the students who are taking out new loans – the risks and all of that.”

He said that the bureau would examine the recent regulatory changes concerning consumer deposits and credit card protections to “see if they have had the intended affects.” The bureau would also be looking to understand the impact of those regulations and determine whether or not the consumer protections are adequate.

He said that the bureau would examine the recent regulatory changes concerning consumer deposits and credit card protections to “see if they have had the intended affects.” The bureau would also be looking to understand the impact of those regulations and determine whether or not the consumer protections are adequate.

Coles said that in Silberman’s approach to the regulatory examination he had stated that he would focus on “topics of risk to consumers.” “Could you elaborate on how you would think about an area that would represent a risk to a consumer?” asked Coles.

Silberman answered that there would be a number of criteria that would be applied to gaining an understanding of risk. “Part of it is size - the more people you’re touching, the greater potential for risk. Part of it is who you’re touching – these are low-income, low age, low education. Part of it could be the rate. Part of it could be the structure or marketing,” he said. “All of those things could factor in to assessing risk and helping us focus our energy.

At the conference, there was no track that truly fit this Q&A presentation. So, it was placed in the product development track. It wasn’t a neat fit, but there are things that banks can do in the early stages of product development to make compliance easier along the way. Coles probed that issue next, with this question, “What product development practices would you like to see that are consistent with the bureau’s overarching objectives?”

Complying with product development

"Engage compliance from the beginning,” said Silberman. “Ask yourself, ‘Does this meet the requirements? Is this fair?’ I think the broader questions that are being asked are ‘Is this the kind of product that I would feel comfortable selling to my mother?’"

“Beyond pricing, what other disclosure would you like to see?” asked Coles.

“Disclosures that are readable,” said Silberman. “Beyond that, disclosures that are read.” (This is an area of sinking sand where banks are concerned, and during the audience questioning later, Silberman admitted that there is no way to make consumers read disclosures. But, he said that a simple, easy to read and interesting disclosure would be more compelling and therefore more likely to be read.) “I’d like to have disclosures that make it easy for consumers to compare. That’s an important role for us [CFPB] to play – to establish some standardization of terminology."

“What are some key actions to ensure a constructive and productive relationship with the CFPB?” asked Coles.

“I think a constructive and productive relationship comes not so much from specific actions, but from an approach,” said Silberman. “Any type of business relationship is founded in mutual respect and honesty. I think that is going to be what is most important. We are very conscious that we are not playing gotcha and seeing banks as adversaries. We think what we are doing is being helpful to financial services providers by creating rules of the road that everybody plays by – to avoid the kinds of situations where folks are forced to do things they’d really rather not do because that is where the market has driven them."