With the exception of the occasional James Bond movie that proves the rule, we don’t as a matter of course combine our modes of transportation into one all-purpose vehicle. But when it comes to financial management, there is one tool , commonly called the Budget, that gets applied to all problems involving dollar signs.

Before we get into the details of exactly how bad of an idea this actually is, a little structure would be beneficial, coming in the form of this three-tier hierarchy for financial management.

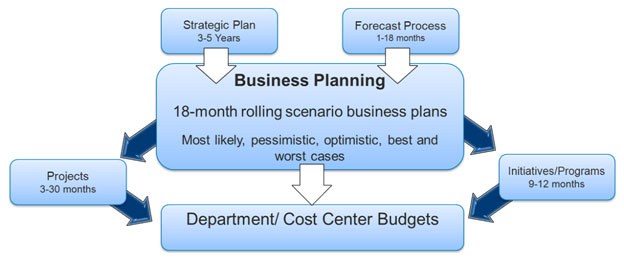

At the top level resides Strategy and the Forecast, or rather, Forecasts, plural, as the enterprise seeks to gain as much information, insight and foresight from as many sources and time horizons as possible, such as 60-day cash collection forecasts from account receivables, 90-day Ops forecasts from ERP, six-month sales forecasts from the field, 9-month staffing and expense forecasts from the functional departments, 1-year product launch forecasts from marketing, and 2-year industry outlooks from the analysts. Forecasting is also typically the primary focus of analytical techniques in the office of finance, with tools such as econometric, regression and trend analysis applied to avoid the gaming of the system, and to improve accuracy and confidence in both the forecast and the resulting decisions.

At the bottom is of course the Budget, the intended output of the whole process. Between these two levels lives the most neglected and under-resourced activity in finance – Planning. Too often we connect the budget directly to the forecast, resulting in reactive knee-jerk responses and half-way measures such as hiring, salary, capital and travel freezes that please no one, not even the CFO who issues them. Or, when the Budget gets too far out of line during the middle of the year, we confound the situation by substituting Variance-to-Budget with Variance-to-Forecast, which merely moves the game playing to a much more detrimental location - you do NOT want games being played with the forecast. Instead, you want the most accurate picture, the best guesses, put forward, unfiltered and unaffected by the current situation or year-end bonuses.

What should drive the Budgets are the Scenarios that result from the planning process; not just the Most-Likely Case, but also the Optimistic, Pessimistic, Best and Worst cases as well.

To drive this point further, consider these definitions that Steve Player shared with us at the recent ABM Smart conference in Charlotte, NC:

- TARGETS: What you’d like to happen

- FORECAST: What you think will happen

- PLANS: What you intend to do

When it comes to the definition of the BUDGET, however, it gets a little messier. Here is just a partial list of what many organizations use the Budget for: Cash planning, Targets and incentives, Investments, Cost understanding, and Resource management. I will submit to you that the use of the Budget should be limited to just that last item – Resource management and allocation, and reallocation, and reallocation, as conditions change, which they always do, and not always in neat 12-month segments aligned with the Gregorian calendar.

The first usage you want to decouple from the Budget are targets and incentives. You cannot be an agile organization, reacting quickly to opportunities and challenges if in order to implement a revised budget you must also renegotiate the associated bonus schemes at all levels across the organization. Targets and incentives are best managed through the use of a Balance Scorecard, where they can be tied to inter-related key metrics and to external benchmarks such as growth and market share that better reflect the health and performance of the organization.

In the next case, investment decisions do not naturally reside comfortably at the level of the budget; they are most at home at the intersection of Strategy and Planning. And lastly, variances to Budget do nothing to improve your understanding of Costs, as they assume what remains to be proven – what SHOULD the costs be. For that you need an understanding of the processes and activities which consume the resources, and the ability to benchmark them with best-in-class players in your industry, capabilities provided by an activity-based management system. As for Cash, we all know that cash ends up being the “plug” that makes the balance-sheet balance, and that every organization relies on a more rigorous treasury process to assure adequate supplies of working capital.

So with the removal of targets, investments, costing and cash, you might ask, “So what’s the Budget for?” The answer: Resource Allocation. And re-allocation, and re-allocation, based on ready-to-hand prebuilt scenarios, complete with predetermined triggers and pre-negotiated revised targets. With that division of labor in place, between budgeting, planning and forecasting, you can react quickly to changing conditions, keep operational activities aligned with strategy, and maintain the integrity of your forecasting process. Leave the “all-in-one-size-fits-all” stuff to James Bond.