This is the seventh and last part of the blog post series “A practical guide to tackle auto insurance fraud”.

In the first six articles of the series we drilled down to:

- Data Management and Data Quality as the basis for fraud detection analytics.

- Business Rules and Watch lists techniques that play always a crucial role for claim handlers and fraud investigators.

- Advanced Analytics which add a layer of defensed towards the unknown fraud typologies that more experienced and organized fraudsters utilize.

- The most powerful advanced analytics technique of Social Network Analysis for uncovering hidden relationships between all involved parties and entities in a claims and not only process.

- Hybrid Scoring in order the insurer to be able to combine all of the above techniques and intelligence in a fraud risk scoring process.

- Investigator’s Interface for analyzing the toolkit for graphical functionalities and visualizations a claims fraud investigator should have, for boosting up investigator’s efficiency, provide optimum fraud detection results and at the same time minimize the time, resources and costs of the investigation process.

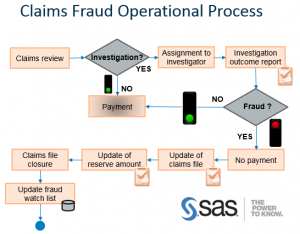

This 7th article is the last in this blog post series and deals with the Operational Processes and Automated Controls, a consulting approach and proposition for applying high-end fraud detection technology in your organization, via embracing and enhancing your current claims handling and fraud detection operational procedures and applying automated controls. This will safeguard that no money will get out of your door in highly suspicious fraud cases.

Claims department organization structure and processes

Each insurer follows a very structured process for the claims announcement, the claims application review and validation, the payment and/or the fraud investigation. In such process various internal and external resources are utilized, e.g.:

- Claim handlers.

- Claims supervisors/managers for providing approval and reviewing of high value claims.

- Legal department for advice or actions in complex situations.

- Internal investigation team (usually very experienced claim handlers or supervisors).

- External investigation consultants that perform “on the field” investigation research for the people and 3rd parties involved, the accident scene and the reported damages.

- Accounting team for finalizing the payments.

At the same time the relevant claims handling resources and employees are utilizing various software applications, e.g.:

- Claim management.

- Policy management.

- Insurance association shared data.

- Accounting system.

- Electronic documents and communications.

Taking into consideration such existing operational and technological environment, the additional utilization of a new modern Fraud Detection System is not something that should be done without a planned re-structuring and enhancement of existing operational procedures and processes. Modern fraud detection analytics system is not just an add-on application that a claims handler should utilize in the day to day work, it is a crucial system for tackling insurance fraud and maximizing fraud detection savings, which needs special attention and clear process workflows in order to provide the optimum results.

It is essential the process workflow to be enhanced with the specific control points that will dictate to the claims handler or supervisor to review the Fraud Systems risk score, the rules violated, the matching with historical cases and hidden connections with other suspicious cases of social network analysis, so to trigger instantly external investigation research and / or the engagement of the legal department, when needed.

Fraud investigation concerns

Claims handlers are working towards customer satisfaction and usually have targets to achieve low average times for claims settlement. This means that by their “nature” are not focused to uncover suspicious fraud cases. From their side “each claimant is innocent unless it is proved guilty”. This does not mean that claims handlers do not have the skills, knowledge and brains to detect fraud, they can and several times they do it with success.

By installing and utilizing a modern Fraud Detection system, sooner or later each insurer will have to face the dilemma if the existing organization structure, focused in claims settlement, fits the same and provide best results also for fraud detection.

Practical experience have shown that although the claims handlers are the first users for a new fraud detection system, sooner or later a specialized internal fraud investigation team, a fraud detection squad, is established. Such teams usually have few high experienced claims handlers and report directly either to the claims unit or other. Claims with high fraud risk scores are automatically assigned to this unit, also high cost claims and/or suspicious claims that have been assigned by claims supervisors or managers. A fraud squad team has the authority to assign cases to external investigators and engage legal department when needed. In a broader level of insurance associations, or even big multinational insurers, staffing with ex-police officers is frequent. Fraud detection requires the opposite “nature” from claim handlers mentality, as the goal is to uncover crime and “each claimant is guilty unless it is proved innocent”.

Automated analytics controls

However even if an insurer utilizes the best fraud detection system and has the best internal organization structure, again money can get out of the door and fraud savings can be minimized. Not only operational processes must be in place, but also automated controls powered by analytics and integration between related systems (claims handling, underwriting, accounting, fraud detection etc.).

Some few examples for automated systemic controls:

- A high fraud risk score claim must not be paid by the accounting department if there is no clearance from the fraud investigation team. This can be achieved via characterizing / flagging a claim like “NoFraud” in the Fraud Detection system and automatically integrating such data flag with the claims handling and accounting applications.

- A high fraud risk score claim file can be “closed” only if specific characterization / flagging is tracked down. This means that such claim can be either “Fraud” or “NoFraud” or “Suspicious Fraud but not proven” or other kind of claims classification that the insurer may need.

- Fraud detection system’s data analytics can trigger focused audits by internal audit department, which can assist not only in streamlining the claims fraud process, but also to uncover more fraud (external or internal). As an example cases for internal audit review can be claims characterized like: (a) “Fraud” but paid or (b) “NoFraud” but have high fraud risk scores or (c) low fraud detection performance that does not follow the norm per various entities (claim handlers, body shops, adjusters, agents/brokers etc.).

Key message

While applying a series of analytics techniques in a fraud detection process, via a hybrid score for every claim, and providing to the fraud investigator all needed data, so to visualize instantly cases that need high attention and to uncover hidden relations with social network analysis, enhancement of existing operational processes and applying automated controls is essential.

Specialized fraud prevention software and relevant project needs to provide such consulting service, as this will secure the best possible day to day fraud detection system utilization and maximize savings.

This was the 7th and the last blog post series article, “A practical guide to tackle auto insurance fraud”. This series explored 7 analytics best practices techniques that insurers need to follow for tackling auto insurance claims fraud.

1 Comment

Pingback: A practical guide for auto insurance fraud – Opening Welcome - Bright Da